Ever wondered why you’re still overspending every month despite vowing to stick to your budget? Yeah, us too. Budget monitoring might sound like a snooze-fest (it kind of is), but without it, your finances can spiral faster than you can say “subscription fees.” In this guide, we’ll unpack how coaching apps are revolutionizing budget monitoring by blending education, accountability, and tech into one sleek package. Ready to go from financial chaos to control? You’ll learn why budget monitoring matters, the best tools out there, actionable tips for success, real-life examples, and more.

Table of Contents

- Why Budget Monitoring Is Your Financial Superpower

- Step-by-Step Guide to Using Coaching Apps for Budget Monitoring

- Tips & Best Practices for Budget Monitoring

- Real-Life Examples of Budget Monitoring Success

- Frequently Asked Questions About Budget Monitoring

Key Takeaways

- Budget monitoring helps identify spending leaks, reduce debt, and increase savings.

- Coaching apps provide personalized guidance, gamification, and accountability.

- Mastering budget monitoring requires consistency, education, and the right tools.

- Avoid common pitfalls like ignoring variable expenses or not adjusting goals regularly.

Why Budget Monitoring Is Your Financial Superpower

Let’s face it—most of us suck at keeping tabs on our money. I once spent an entire paycheck on “just a few Amazon orders,” only to realize later I needed groceries. Sound familiar? Budget monitoring is like putting guardrails on your spending so you don’t crash into financial ruin. But here’s the kicker: traditional spreadsheets and mental math just don’t cut it anymore. That’s where coaching apps step in.

Confessional Fail Alert: One day, I forgot to log my coffee runs for two weeks straight. The result? A $200 hole in my budget that felt like betrayal. If that doesn’t scream “I need better tools,” nothing does.

These days, coaching apps blend education with practical tools, making budget monitoring less painful—and dare I say, kinda fun?

Step-by-Step Guide to Using Coaching Apps for Budget Monitoring

Optimist You: “This is going to be easy!”

Grumpy Me: “Ugh, fine—but only if snacks are involved.”

Step 1: Choose the Right App

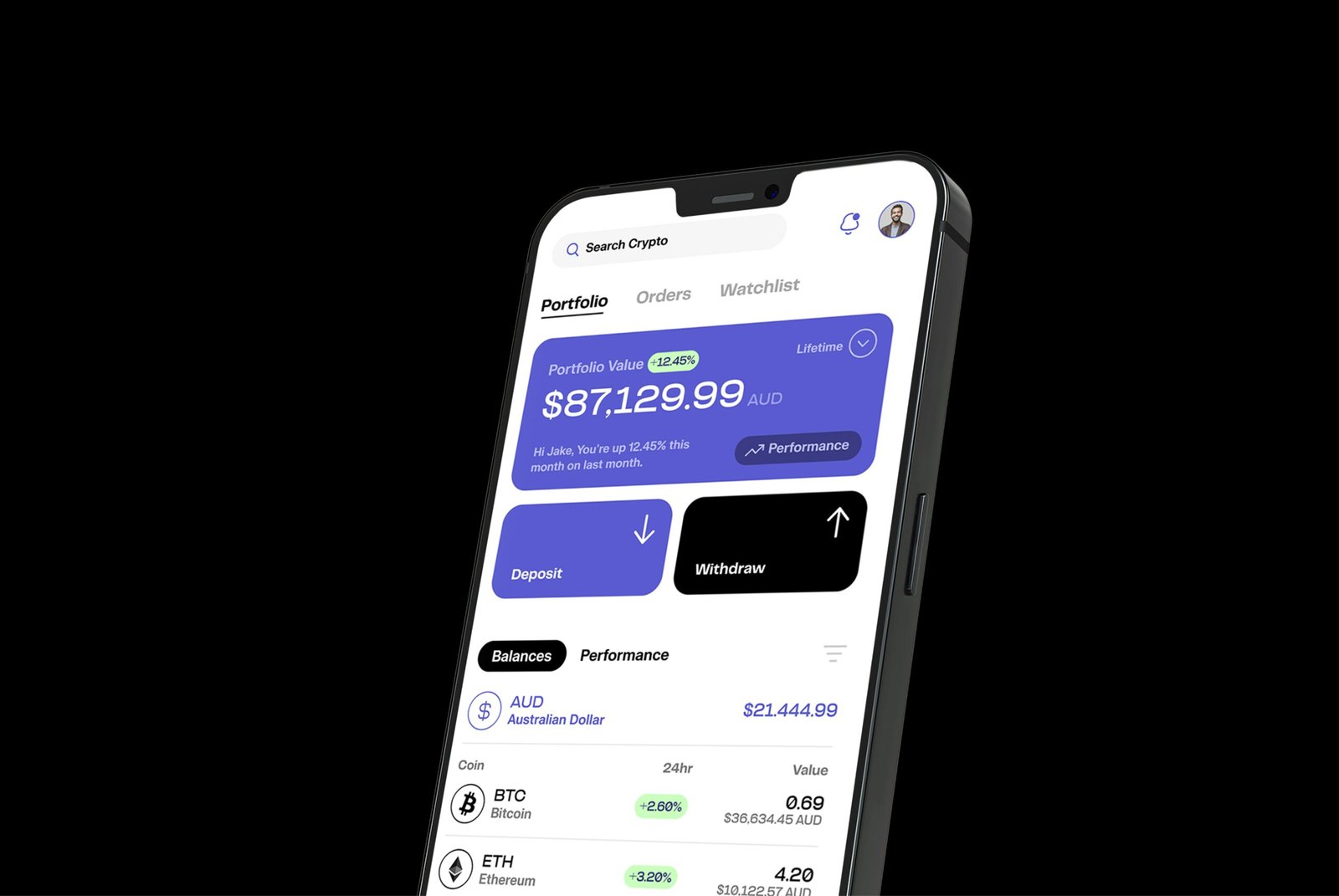

Not all coaching apps are created equal. Some focus on saving, others on investing, and a few offer holistic financial wellness. Look for apps that sync with your bank accounts, track spending patterns, and send reminders when you’re nearing limits.

Step 2: Set Clear Goals

No vague resolutions allowed. Break down your objectives into measurable chunks, like saving $500/month or cutting entertainment spending by 20%.

Step 3: Automate Everything

“Automation is chef’s kiss for drowning algorithms,” as they say. Use features within your app to automatically categorize expenses, set aside savings, and even pay bills.

Step 4: Review Weekly

Block off 15 minutes each week to review your progress. Trust me; hearing “You’ve exceeded your dining-out limit” stings less than maxing out your credit card.

Tips & Best Practices for Budget Monitoring

- Educate Yourself: Many coaching apps include courses or articles. Learn about compound interest, emergency funds, and mindful spending.

- Stay Consistent: Like watering a plant, skipping even a week can kill your momentum.

- Involve a Friend: Accountability buddies make everything easier, including sticking to your budget.

(Terrible Tip Disclaimer) Don’t try to DIY your way through complex investments without consulting an expert. It’s a recipe for disaster.

Real-Life Examples of Budget Monitoring Success

Rant time! Why do people act surprised when their budgets fail after ignoring variable expenses like holidays or car repairs?! Okay, deep breaths… now let’s talk about Jane, who paid off $12k in student loans using a mix of budget monitoring and a top-rated coaching app. Her secret? She tracked every single penny for six months while taking short courses inside her app to improve her financial literacy.

Frequently Asked Questions About Budget Monitoring

Q: How long does it take to see results?

A: Typically, 1–3 months if you stick to your plan consistently.

Q: Are coaching apps worth the cost?

A: Absolutely! Most premium versions pay for themselves in saved money.

Q: What if I mess up my budget?

A: Start again tomorrow. Progress over perfection!

Conclusion

You made it! By now, you understand why budget monitoring is crucial, how coaching apps streamline the process, and what steps to take to achieve financial health. Remember, consistency beats perfection, and small wins add up. Now go forth and conquer those finances—one monitored dollar at a time!

P.S. Like Pikachu evolving into Raichu, your budget game will level up quickly—trust the process. 😊