“Ever felt like you’re spinning your wheels in personal finance, but can’t quite figure out why?” Yeah, us too. Whether it’s budgeting apps that collect digital dust or online courses you never finish, staying accountable in your personal finance education is easier said than done. That’s where progress reports come into play—especially when integrated into coaching apps.

In this post, we’ll deep-dive into how progress reports serve as the ultimate accountability hack for mastering personal finance education and courses through coaching apps. You’ll discover:

- Why progress tracking is essential (even if it sounds boring).

- A step-by-step guide to leveraging these reports effectively.

- Real-life examples proving they work wonders.

Table of Contents

- Key Takeaways

- Section 1: The Problem with Personal Finance Education

- Section 2: How to Leverage Progress Reports in Coaching Apps

- Section 3: Best Practices for Using Progress Reports

- Section 4: Real-World Examples

- FAQs

Key Takeaways

- Progress reports provide actionable insights to stay on track with personal finance goals.

- Coaching apps integrate gamification elements to make financial learning engaging.

- Ignoring progress reports = missing out on critical feedback loops for success.

Section 1: The Problem with Personal Finance Education

Here’s the brutal truth about personal finance education: most people buy fancy courses, download flashy apps, and then promptly forget about them. According to a 2022 study by Wyzowl, over 85% of learners abandon their online courses before completion. Why? Because motivation fades faster than coffee on a Monday morning.

Confessional fail alert: I once joined an expensive money management program, only to realize three months later I hadn’t opened the app since Week 1. Ugh. Worse still, without any form of tracking my efforts, all I had was guilt and no clear path forward.

This is where progress reports shine—they’re like your personal Jiminy Cricket, keeping you honest while whispering “You’ve got this!”

Section 2: How to Leverage Progress Reports in Coaching Apps

Optimist You: “I should totally use these reports to crush my financial goals!”

Grumpy You: “Ugh, fine—but only if there’s coffee involved.”

Fair enough. Let’s break down how to actually use progress reports in coaching apps:

Step 1: Set SMART Financial Goals

First things first—define Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) objectives. For example, instead of saying “I want to save more,” say “I aim to save $500 per month toward my emergency fund.”

Step 2: Choose a Coaching App With Robust Reporting

Not all coaching apps are created equal. Look for options offering detailed analytics dashboards, like YourCoach, which breaks down everything from time spent on lessons to savings milestones achieved.

Step 3: Review Weekly Progress Reports

Don’t skip this part—it’s crucial for long-term success! Many apps send automated summaries via email or push notifications. Treat these updates like weekly check-ins with your future billionaire self.

Section 3: Best Practices for Using Progress Reports

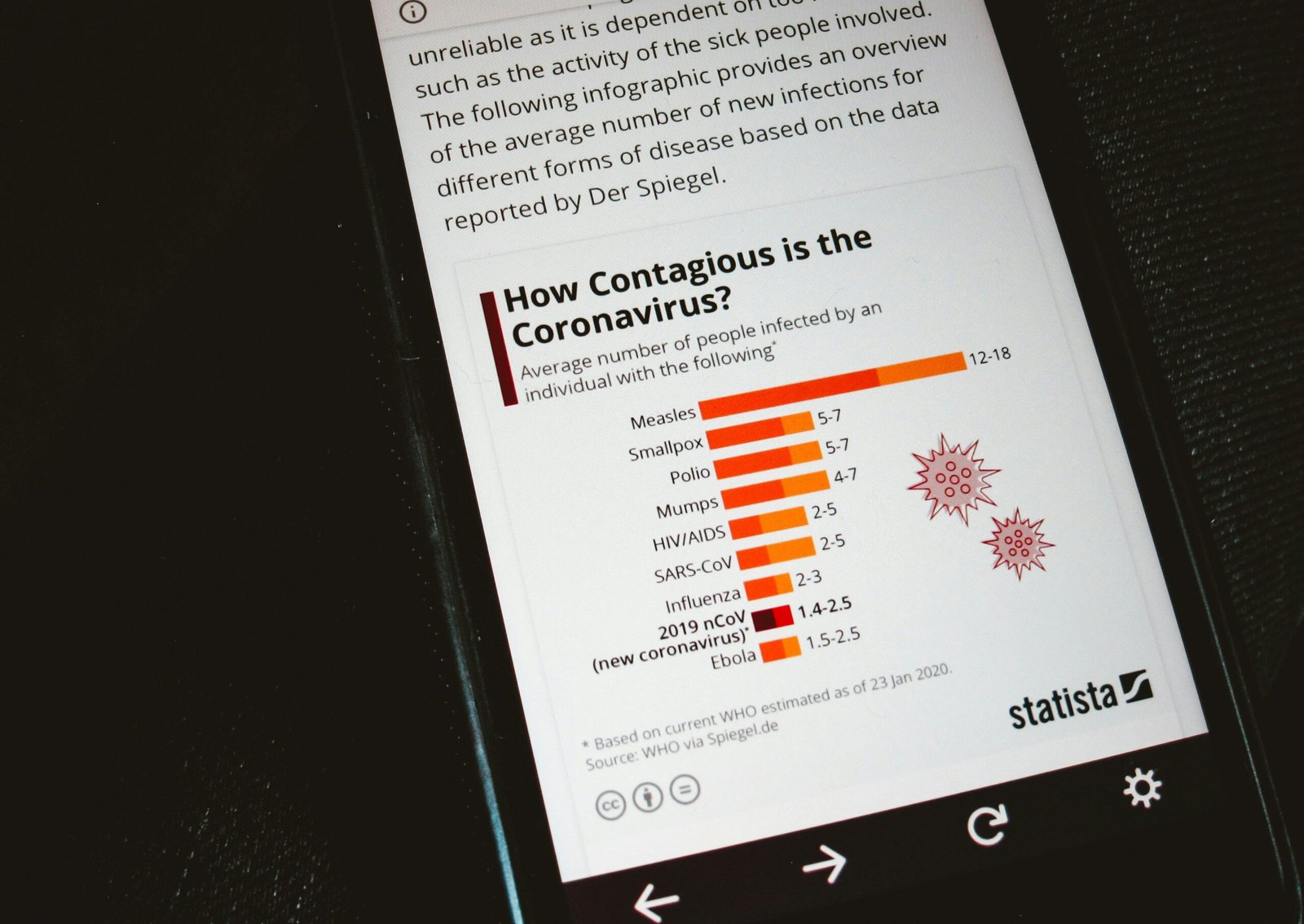

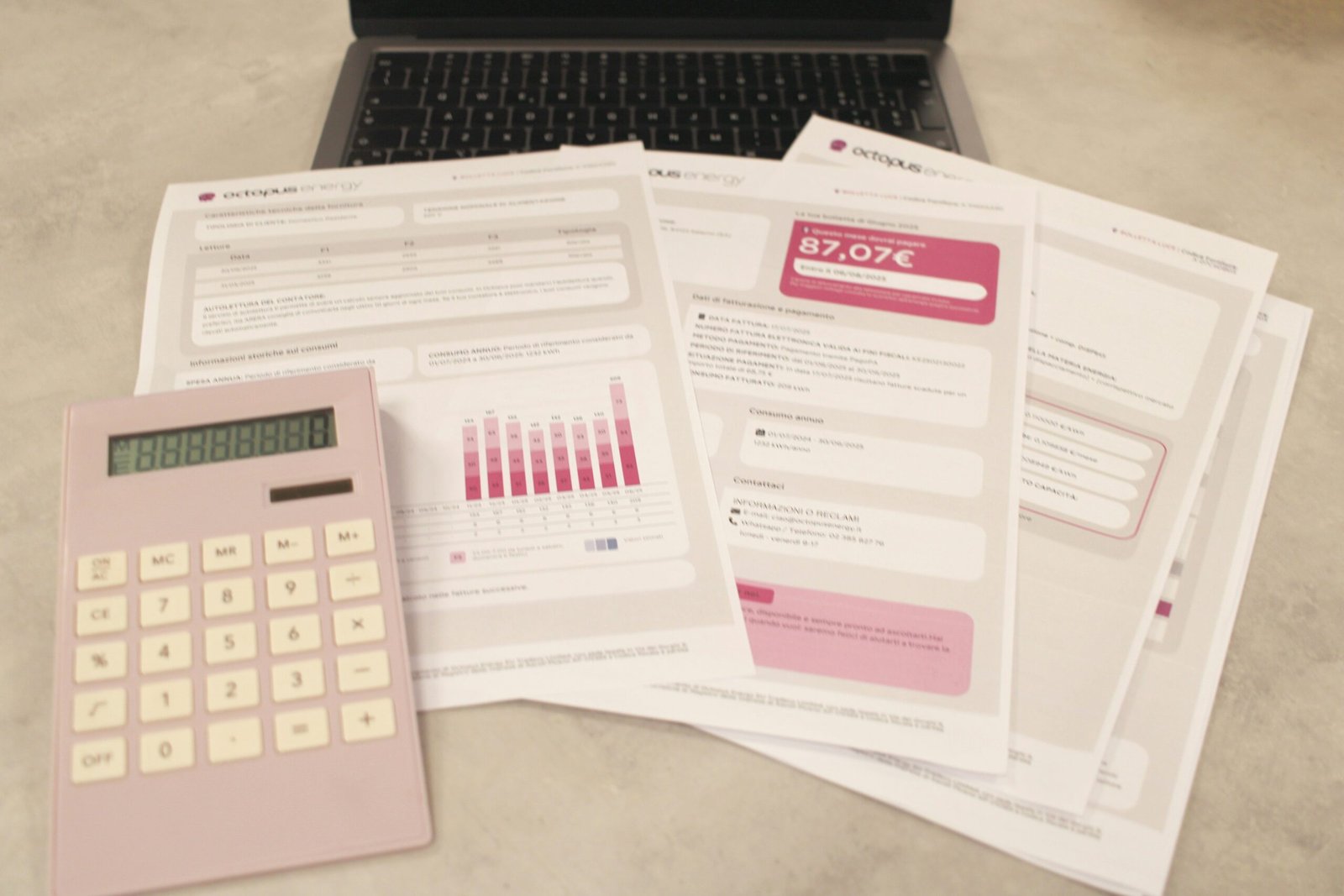

- Keep It Visual. Charts and infographics aren’t just fun—they help you process data quickly. A simple pie chart might reveal you’re spending way too much on avocado toast.

- Set Alerts. Enable reminders or notifications so you don’t ghost your own progress.

- Celebrate Wins. Did you hit a milestone? Show yourself some love. This isn’t just feel-good fluff; celebrating small wins boosts retention rates.

Anti-advice warning: Don’t become obsessed with perfection. Sometimes progress reports highlight areas needing improvement, but obsessing over minor setbacks will only burn you out. Remember, slow and steady wins the race.

Section 4: Real-World Examples

Let’s talk real stories. Meet Sarah, a 29-year-old teacher who used a popular coaching app to pay off $20k in student debt within two years. Her secret weapon? Detailed progress reports.

“Every Sunday, I’d review my report,” she says. “It showed me exactly where I could cut back—like those daily lattes—and kept me laser-focused.”

FAQs

Q: Are progress reports really necessary?

Absolutely. Without them, you risk losing sight of your goals—or worse, repeating past mistakes without realizing it.

Q: What if my app doesn’t offer progress reports?

No problemo. Use external tools like Google Sheets or Notion to manually log your achievements. Low-tech works too!

Q: Can progress reports replace professional advice?

Short answer: Nope. While helpful, they complement—not replace—expert guidance. Think of them as the sidekick, not the superhero.

Conclusion

To recap, progress reports are the unsung heroes of personal finance education. They keep you grounded, focused, and motivated—all while delivering actionable insights tailored to your journey. So next time you think about skipping that weekly review… remember Sarah, the latte-lover-turned-debt-slayer.

And hey, here’s a bonus nugget of wisdom straight from the early 2000s: Like a Tamagotchi, your finances need daily care. Feed them well, nurture them often, and watch them grow.