Ever stared at your bank account, wondering where all the money went this month? You’re not alone.

Managing personal finances can feel like trying to solve a Rubik’s Cube blindfolded. But here’s the kicker—what if I told you that monthly financial reports could be your secret weapon for achieving financial clarity? And what if coaching apps were there to guide you through it step by step?

In this post, we’ll break down:

- Why monthly financial reports are game-changers for education-focused personal finance.

- How top coaching apps use these reports to help users stay on track.

- Actionable tips to leverage monthly financial reports for smarter spending habits.

- Real-world examples of people who transformed their finances with coaching apps.

Table of Contents

- The Problem: Why Monthly Financial Reports Matter More Than Ever

- Step-by-Step Guide to Creating Killer Monthly Financial Reports

- Tips and Best Practices for Using Coaching Apps Effectively

- Case Studies: Real People, Real Results

- FAQs About Coaching Apps and Monthly Financial Reports

Key Takeaways

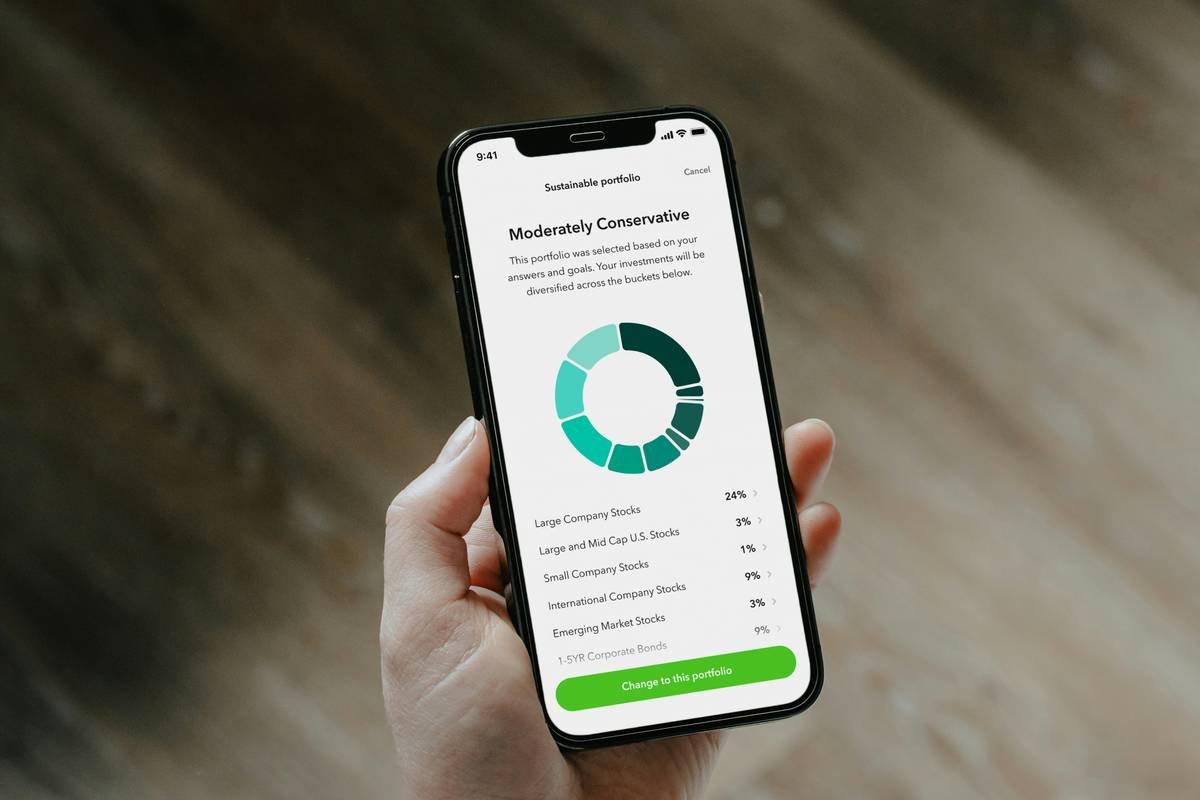

- Monthly financial reports offer a clear snapshot of your financial health, helping you make smarter decisions.

- Coaching apps amplify the benefits of monthly reporting by providing personalized advice and tracking tools.

- You don’t need an accounting degree—just consistency and the right tech tools—to master your money.

The Problem: Why Monthly Financial Reports Matter More Than Ever

Let me paint you a picture. A few years ago, I downloaded a shiny new budgeting app (you know the kind—rainbows everywhere). Fast forward one year, and my finances were still a trainwreck because I never reviewed my monthly financial reports. Sound familiar?

“Optimist Me:” Oh, those charts will magically fix everything!

“Grumpy Me:” Ugh, until you actually LOOK at them, they’re useless.

Data from Mint.com shows that 65% of Americans don’t keep a detailed record of their expenses, which makes living paycheck to paycheck almost inevitable. Without regular check-ins via monthly financial reports, even the best-intentioned budgets fall flat.

Step-by-Step Guide to Creating Killer Monthly Financial Reports

So, how do you create powerful monthly financial reports without losing your mind?

Step 1: Start With a Budget Baseline

If you skip setting a baseline, you’re just throwing darts in the dark. Tools like YNAB (You Need a Budget) let you set realistic limits for categories like groceries, entertainment, and savings.

Step 2: Track Your Spending Religiously

Here’s where most people stumble—they track for two weeks, then ghost themselves. Pro tip: Automate as much as possible using banking integrations in popular apps like PocketGuard or Tiller.

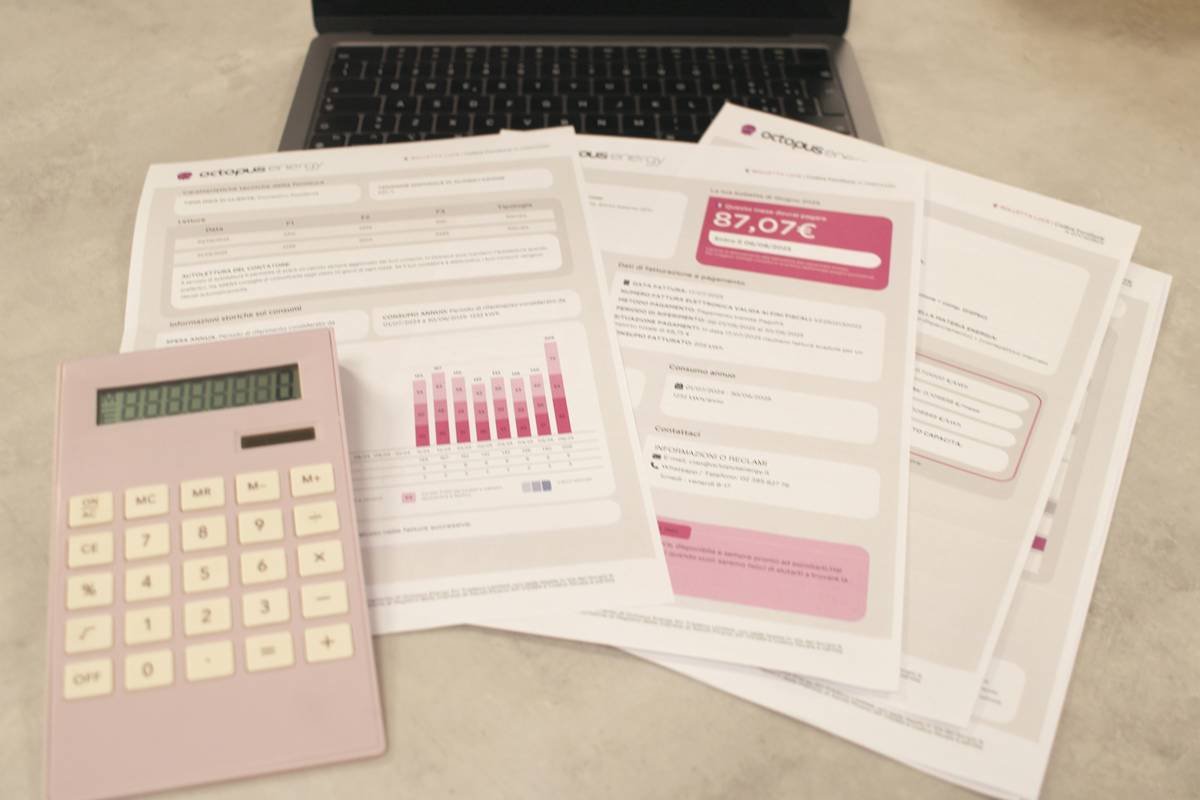

Step 3: Analyze Patterns in Your Monthly Financial Reports

Look beyond raw numbers. Did you overspend on coffee runs? Did unexpected bills wreck your cash flow? These insights are gold.

Pro Tip From Me: Sync Your Reports Across Coaching Apps

Many coaching apps sync seamlessly with budgeting tools to give actionable feedback. Imagine having a digital cheerleader AND analyst rolled into one!

Tips and Best Practices for Using Coaching Apps Effectively

- Choose an App That Matches Your Goals: Some focus on debt repayment; others prioritize investing. Pick wisely.

- Set Reminders to Review Your Reports: Treat it like date night—with spreadsheets.

- Don’t Ignore Behavioral Insights: Most apps provide nudges based on your spending patterns. Pay attention!

Warning: Avoid Free Trials Without Commitment. Signing up for every free trial under the sun might sound tempting, but switching apps constantly can lead to financial ADHD—focus is key!

Case Studies: Real People, Real Results

Sarah, a single mom from Texas, struggled with credit card debt until she started using a combination of Clarity Money and a career coaching platform. By reviewing her monthly financial reports weekly, she paid off $10,000 within six months.

“It felt like someone finally turned the lights on,” Sarah says.

FAQs About Coaching Apps and Monthly Financial Reports

Q: Are monthly financial reports enough to handle complex finances?

A: Not always. For intricate needs, consult a certified financial planner alongside your reports.

Q: Do I really need an app, or can I go old-school with spreadsheets?

A: Both work, but apps save time and reduce errors—your call!

Q: What if I miss a month—is all hope lost?

A: Nope! Just jump back in. Progress trumps perfection.

Conclusion

Monthly financial reports aren’t just boring pieces of paper—they’re roadmaps to better financial freedom when paired with coaching apps. Whether you’re paying off debt, building wealth, or avoiding future meltdowns, these tools have got your back.

Remember: “Consistency over complexity.” So grab your favorite latte, open that app, and start creating a brighter financial future today.

Bonus Haiku:

Numbers tell stories, Apps guide our financial paths, Money finds its home.