“Ever stared at your bank account and felt like you’re decoding alien hieroglyphics? You’re not alone.”

Managing personal finances can feel overwhelming, especially when faced with complex spreadsheets or intimidating terms. But what if there was a way to simplify this chaos into actionable insights? Enter financial health reports, the unsung heroes of modern financial literacy—especially when paired with cutting-edge coaching apps.

In this post, we’ll explore how financial health reports work within coaching apps, why they’re essential for improving financial wellness, and the steps you need to take to leverage them effectively. Ready? Let’s dive in!

Table of Contents

- Why Financial Health Reports Matter

- How Coaching Apps Use These Reports

- Step-by-Step Guide to Using Financial Health Reports

- Tips for Maximizing Your Results

- Real-World Success Stories

- Common FAQs About Financial Health Reports

Key Takeaways

- Financial health reports break down your financial status into digestible, actionable insights.

- Coaching apps enhance these reports by providing personalized guidance and accountability.

- Using these tools consistently leads to better spending habits and long-term financial stability.

Why Financial Health Reports Matter

Let’s be honest: most people don’t have a clue about their financial standing beyond whether they’ve overdrafted this month. Spoiler alert—that’s a recipe for disaster.

A 2022 study by LendingClub revealed that over 60% of Americans live paycheck to paycheck. That stat isn’t just alarming; it’s a wake-up call for anyone trying to achieve financial independence.

Confessional Fail: Back in my early twenties, I downloaded an app promising to help me budget—but ended up ignoring every notification until I got hit with overdraft fees. Sound familiar?

This is where financial health reports come in. They provide a snapshot of your income, expenses, savings rate, debt levels, and more, helping you identify areas for improvement without needing a degree in finance.

How Coaching Apps Use These Reports

Think of a coaching app as your digital accountability partner. It doesn’t just spit out numbers—it interprets them through tailored advice, nudges, and progress tracking. Here’s how:

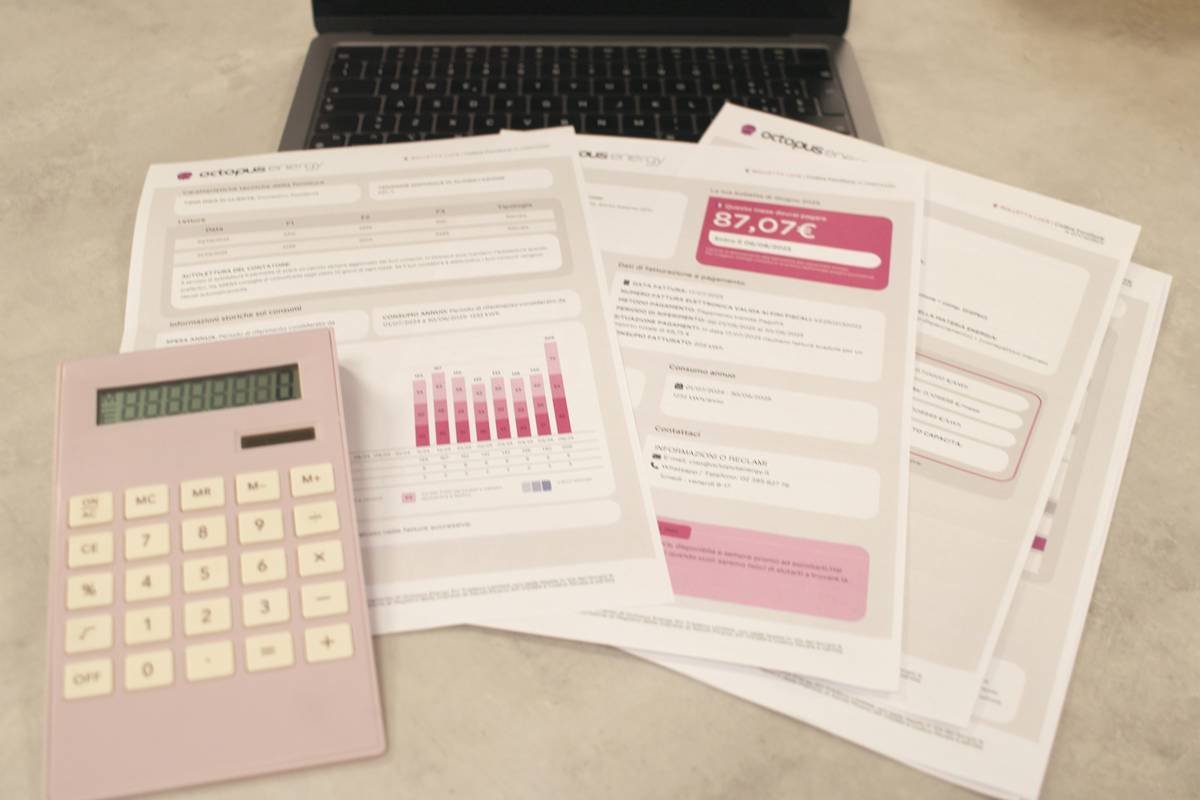

- Data Visualization: Complex data becomes colorful charts and graphs.

- Behavioral Insights: Algorithms analyze patterns to suggest changes (like reducing impulse buys).

- Goal Setting: Break big goals (e.g., paying off student loans) into smaller milestones.

“Optimist You: ‘These apps will change everything!’

Grumpy You: ‘Yeah, right—only if I stop snoozing those morning reminders.'”

Step-by-Step Guide to Using Financial Health Reports

Step 1: Choose the Right App

Not all apps are created equal. Look for features like customizable dashboards, automated categorization of expenses, and integration with your bank accounts.

Step 2: Link Your Accounts Securely

Ensure the app uses robust encryption protocols before linking your accounts. Safety first, always.

Step 3: Review Your First Report

Take time to understand each section: net worth, cash flow, debt ratios, etc. Don’t panic if things look grim initially—it’s about progress, not perfection.

Step 4: Set Actionable Goals

Based on the report, decide what needs fixing first. Is it curbing unnecessary subscriptions? Building an emergency fund?

Step 5: Track Weekly Progress

Consistency is key. Schedule weekly check-ins to monitor your journey.

Tips for Maximizing Your Results

- Automate Savings: Set up automatic transfers to ensure you’re paying yourself first.

- Use Gamification: Some apps reward you for meeting goals—it’s oddly satisfying.

- Limit Free Trials: Those sneaky $7 “intro offers” add up faster than you think.

- (Terrible Tip Disclaimer): Avoid micromanaging every penny unless OCD is your love language.

Rant Time: Ugh, seriously, why do so many apps charge extra for basic features like exporting PDFs? Feels like paying twice for the same thing.

Real-World Success Stories

Meet Sarah, a 34-year-old teacher who used a popular coaching app to pay off $20k in credit card debt within two years. Her secret? Regularly reviewing her financial health reports and adjusting her strategies accordingly.

“Seeing the numbers improve week after week kept me motivated,” she says. “I never thought I’d achieve this kind of control over my money.”

Common FAQs About Financial Health Reports

- Are financial health reports accurate?

- Mostly, yes—if linked correctly. Always double-check manual entries to avoid errors.

- Can coaching apps replace financial advisors?

- Nope. While helpful, apps lack the human touch required for complex scenarios like estate planning.

- Will using these tools really improve my financial health?

- Absolutely—as long as you act on the insights provided.

Conclusion

From breaking free of paycheck-to-paycheck cycles to building lasting wealth, leveraging financial health reports in coaching apps can revolutionize how you handle money. Remember: knowledge is power, but action turns that power into results.

Ready to transform your financial future? Start exploring apps today and make those reports work for you. And hey, treat yourself to a coffee while doing it—you deserve it.

P.S. Like Pokémon cards, your financial growth will evolve with consistent effort. Gotta catch ’em all!