Ever stared at a jumbled spreadsheet wondering where your hard-earned money disappeared? Yeah, us too. But here’s the kicker: families who use a family budget template save up to 20% more annually. Yet, only 32% of households actually stick to one consistently. Why?

In this article, we’re diving deep into the world of digital tools—specifically coaching apps—that can turn you from clueless spender to financial wizard. You’ll learn:

- Why traditional budgeting often fails (spoiler: it’s not just laziness).

- Step-by-step instructions for creating a rock-solid family budget template.

- Best practices and tips to stay on track using cutting-edge coaching apps.

Table of Contents

- Key Takeaways

- The Problem: Why Family Budgets Fail

- Your Guide to Building a Family Budget Template

- Top Tips for Sticking to Your Budget

- The Best Coaching Apps for Budgeting Success

- Frequently Asked Questions

Key Takeaways

- A family budget template helps organize spending but needs consistent tracking to work.

- Coaching apps provide accountability and automation for better adherence.

- Common pitfalls include underestimating expenses and skipping emergency funds.

- You don’t have to be perfect—just start somewhere!

The Problem: Why Family Budgets Fail

I once created what I thought was the ultimate family budget template—complete with color-coded categories, pie charts, and even an emoji rating system for expenses. Two months later? It sat untouched in my Google Drive graveyard.

Sound familiar? Turns out, there are three big reasons most budgets crash and burn:

- Lack of Accountability: Who’s going to yell at you if you overspend on takeout every Friday?

- No Flexibility: Life happens—car repairs, birthdays, unexpected vet bills. Rigid plans make people give up fast.

- Boring Systems: Let’s face it; spreadsheets aren’t exactly “chef’s kiss” for motivation.

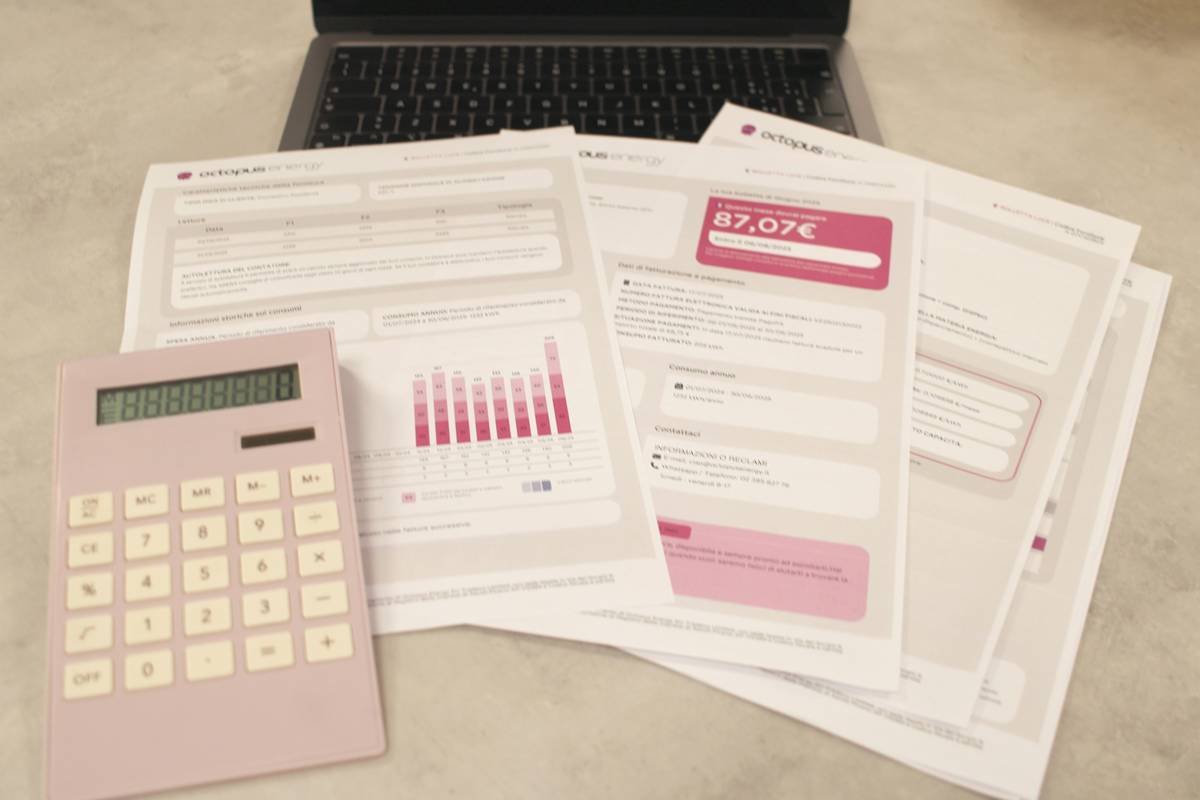

The result of neglecting a family budget template—not pretty.

Your Guide to Building a Family Budget Template

Optimist You: “Okay, let’s do this!”

Grumpy You: “Ugh, fine—but only if coffee’s involved.”

Here’s how to build a sustainable family budget template step by step:

Step 1: Track Every Penny for a Month

Use a simple app or pen-and-paper method to log all income and expenses. Yes, even that $2 gum pack.

Step 2: Categorize Spending

Divide everything into groups like housing, groceries, entertainment, debt repayment, savings, etc.

Step 3: Set Realistic Goals

Decide what percentage goes toward each category based on your priorities. For example, maybe dining out is capped at 5% while saving for vacation gets 10%.

Example of a user-friendly family budget template.

Top Tips for Sticking to Your Budget

- Automate Savings: Set up automatic transfers to avoid forgetting about your goals.

- Review Regularly: Once a week, check progress together as a family.

- Include Fun Money: Denying yourself completely backfires. So allocate guilt-free cash!

- TERRIBLE TIP ALERT: Skipping an emergency fund because ‘nothing bad will happen.’ Spoiler: Something always does.

The Best Coaching Apps for Budgeting Success

Now, let’s talk tech tools—the true game-changers. Here’s our top pick:

Mint + YNAB Combo

Mint tracks spending automatically, while You Need A Budget (YNAB) teaches long-term habits through its coaching-style interface. Together? Magic.

| Feature | Mint | YNAB |

|---|---|---|

| Expense Tracking | Automatic | Manual |

| Budgeting Style | Passive | Active |

| Cost | Free | $14.99/month |

Mint makes expense categorization effortless.

Frequently Asked Questions

Do I Really Need a Family Budget Template?

Yes. Without one, it’s nearly impossible to see where your money’s going—or disappearing.

Can Kids Use These Coaching Apps Too?

Absolutely! Teaching kids early sets them up for lifelong financial health.

What If My Partner Isn’t On Board?

Framing the conversation around shared dreams (vacations, home renovations) usually works wonders.

Conclusion

Creating a family budget template doesn’t have to feel like climbing Mount Everest barefoot. With the right mindset—and some killer coaching apps—you’ll soon see your savings grow faster than your Amazon cart. Remember, small steps lead to big wins.

Like Tamagotchi care in the ‘90s, maintaining a budget requires daily love and attention. Now go forth, conquer those numbers, and live life like the financially savvy boss you were born to be!

Haiku Bonus:

Budgets thrive with care,

Apps keep chaos far away.

Freedom tastes sweet.