Ever stared at your income vs expense report and felt like you were deciphering ancient hieroglyphs? Yeah, us too. For most people, managing finances feels like trying to solve a Rubik’s Cube blindfolded—frustrating and messy. But here’s the good news: with the right tools (like coaching apps), mastering this financial puzzle can become as easy as swiping left on Tinder.

In this post, we’ll explore how leveraging coaching apps in the realm of personal finance education transforms your understanding of income vs expense reports. You’ll learn:

- Why income vs expense tracking is non-negotiable for financial health;

- A step-by-step guide to creating an accurate income vs expense report;

- Tips for selecting the right coaching app that fits your budget and goals;

- Real-life examples of people who’ve been there, done that—and thrived.

Table of Contents

- Key Takeaways

- The Struggle with Income vs Expense Reports

- Step-by-Step Guide to Mastering Your Income vs Expense Report

- 5 Best Practices for Using Coaching Apps

- Success Stories: Real People Killing It Financially

- FAQs About Income vs Expense Reports & Coaching Apps

Key Takeaways

- Tracking income vs expenses helps identify spending leaks before they tank your savings.

- Coaching apps provide hands-on guidance tailored to your unique financial situation.

- The worst advice? Ignoring small expenses—they add up faster than autocorrect fails.

Why Is Tracking Income vs Expenses So Hard?

Imagine this: I once spent $300 on “emergency snacks” because my pantry was always mysteriously empty. Turns out, those $5 granola bars every other day weren’t such emergencies after all. Oops.

This kind of overspending happens when you don’t have a clear picture of what’s coming in versus what’s going out. The problem isn’t just laziness—it’s not knowing where to start. Traditional spreadsheets feel overwhelming, while pen-and-paper methods lead to crumpled receipts buried under couch cushions.

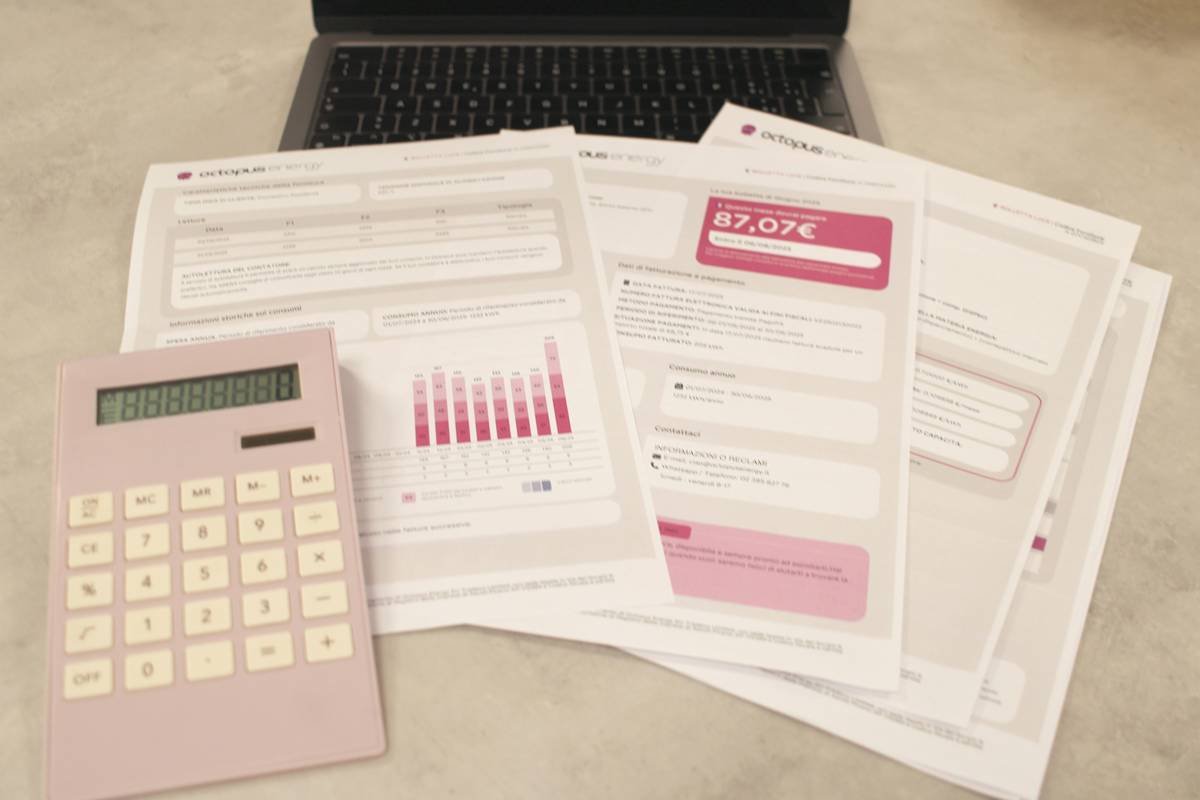

(Infographic: Visual breakdown of common income streams vs typical monthly expenses.)

Sounds familiar? Don’t worry—you’re not alone. A whopping 60% of Americans live paycheck to paycheck, unable to track their cash flow effectively. That’s where coaching apps come in—they simplify the process without making you want to pull your hair out.

Step-by-Step Guide to Mastering Your Income vs Expense Report

Optimist You: “I’ve got this!”

Grumpy You: “Ugh, fine—but only if coffee’s involved.”

Step 1: Choose a Coaching App That Gets You

Not all coaching apps are created equal. Some focus on budgeting basics, while others dive deep into investment strategies. Look for one that matches your financial literacy level and lifestyle. Popular options include Mint, YNAB, and PocketGuard.

Step 2: Sync All Accounts (Bank, Credit Cards, Loans)

Think of syncing accounts like organizing your sock drawer. At first glance, it seems tedious, but boy does it make finding things easier later. Most apps securely connect to over 10,000 financial institutions worldwide.

Step 3: Set Spending Limits Based on Priorities

Confessional fail: Once upon a time, I allocated $100 monthly for “miscellaneous fun.” By week two, I’d already blown through it on artisanal matcha lattes. Moral of the story? Be realistic—or else your income vs expense report will look scarier than a horror movie marathon.

Step 4: Track Daily Transactions

No more guessing games about where last Friday night’s pizza funds went. With coaching apps, every transaction gets logged automatically. Just tap to categorize—one less task cluttering your brain!

Step 5: Review Weekly Progress

This part might sound boring, but trust me: Watching your savings grow feels better than binge-watching Netflix. Plus, regular check-ins help catch errors early.

5 Best Practices for Using Coaching Apps

- Don’t Ignore Small Expenses: Remember my granola bar fiasco? Yeah, little things count.

- Categorize Wisely: Label each expense accurately (e.g., Groceries ≠ Restaurant Dining).

- Set Reminders: Use push notifications to avoid forgetting to log manual entries.

- Adjust Goals Regularly: Life changes, so should your financial plan.

- Stay Patient: Building wealth takes time. Don’t expect overnight millionaires unless Beyoncé calls.

(Comparison Table: Free vs Paid Features of Leading Coaching Apps)

Success Stories: Real People Killing It Financially

Let’s talk Sarah from Ohio. She started using YNAB three years ago after realizing her latte habit cost her nearly $2,000 annually. Fast forward, she now saves enough to take dream vacations twice a year—all thanks to sticking to her income vs expense strategy.

Another example? Meet James, a freelancer drowning in debt until he discovered PocketGuard. His personalized insights helped him eliminate unnecessary subscriptions and redirect money toward his student loans. Today, James boasts a six-figure net worth.

(Before/After Screenshot: Chaotic Pre-Coaching App Report vs Organized Post-Use Version)

FAQs About Income vs Expense Reports & Coaching Apps

How often should I update my income vs expense report?

Ideally weekly. Consistency keeps surprises minimal and progress visible.

Can I use multiple coaching apps simultaneously?

You technically could, but why stress yourself? Stick to one solid app and master it instead.

What’s the biggest mistake people make with these reports?

Glossing over small purchases. They may seem insignificant individually, but collectively? Ouch.

Is privacy ensured with these apps?

Reputable apps encrypt data and comply with regulations like GDPR and PCI DSS. Still, read terms carefully.

Conclusion

There you have it—a roadmap to conquering your income vs expense report with the help of coaching apps. Whether you’re chasing financial independence or simply trying to stay afloat, taking control of your numbers empowers you to live smarter, not harder.

To recap:

- Start by choosing the right app that aligns with your needs;

- Sync accounts, set limits, and review regularly;

- Stay consistent and patient—the results will follow.

And hey, remember: Even Jedi Masters had to start somewhere. May the force of frugality be with you!

P.S. Here’s your random haiku for today:

Dollars flowing out,

Cents saved bring dreams closer,

Budget wisely, friend.