Ever stared at your bank account, wondering why your budget feels like a failed experiment? You’re not alone. Whether you’re a financial coach or someone trying to get their money in order, nailing the right budget examples can feel like chasing unicorns. But here’s the twist: it doesn’t have to be that hard. Today, we’ll explore how coaching apps and budget examples can make your financial journey smoother than ever.

In this post: We’ll dive into why budget examples matter for financial coaching success, how to use coaching apps effectively, actionable strategies to build better budgets, and common pitfalls to avoid. Let’s get started!

Table of Contents

- Why Budget Examples Matter for Coaching Success

- Step 1: Choosing the Right Coaching Apps for Budgeting

- Step 2: Budgeting Best Practices for Coaches

- Step 3: Real-Life Budget Examples That Work

- FAQs About Budget Examples & Coaching Apps

Key Takeaways

- Budget examples provide practical templates for clients struggling with personal finance.

- Coaching apps streamline budget tracking and accountability.

- Avoid generic advice—personalized budget examples yield better results.

- Real-world case studies show tangible improvements in financial health when using tailored budgets.

Why Budget Examples Matter for Coaching Success

Think about the last time you tried explaining “debt snowball” or “50/30/20 rule” to a client. Did their eyes glaze over faster than coffee on a Monday morning? That’s because abstract concepts need concrete visuals. Budget examples are the ultimate cheat codes for simplifying complex ideas.

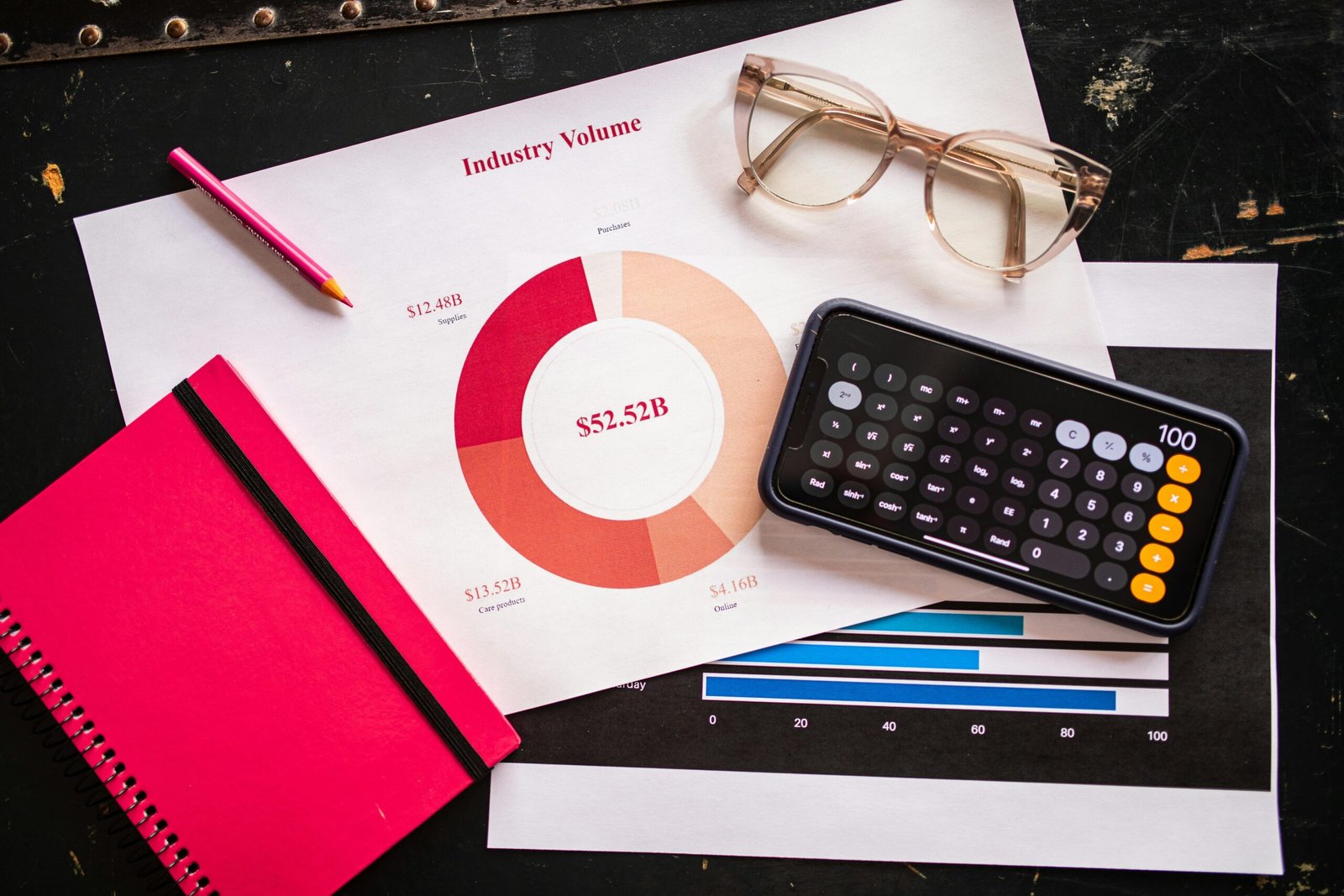

Image: A visual representation of why budget examples simplify financial planning.

From my own experience as a financially clueless newbie years ago, throwing numbers at people without context is a recipe for disaster. One day, I created a simple grocery budget example for myself (and stuck it on the fridge). Suddenly, $7 lattes stopped happening every afternoon. It wasn’t rocket science—it was just clarity.

“Optimist You:* ‘Follow these tips!’

Grumpy You: ‘Ugh, fine—but only if coffee’s involved.'”

Step 1: Choosing the Right Coaching Apps for Budgeting

Not all coaching apps are created equal. Some are sleek and intuitive; others feel like they were designed by confused robots. Here’s what to look for:

- User-Friendly Interface: If an app looks like NASA control panels, delete it. Seriously.

- Customization: Your budget isn’t one-size-fits-all. Look for apps allowing flexible categories.

- Automation Features: Automatic expense tracking saves hours of manual entry drudgery.

Personally, I swear by YNAB (You Need A Budget) combined with PocketGuard—it’s chef’s kiss for drowning algorithms. And no, I’m not sponsored by them, though I wouldn’t mind being!

Step 2: Budgeting Best Practices for Coaches

Here’s where things get spicy. Follow these practices to help clients stick to their budgets:

- Set SMART Goals: Specific, Measurable, Achievable, Relevant, Timely. No more vague goals like “save more.”

- Track Regularly: Encourage weekly check-ins rather than waiting until month-end.

- Celebrate Wins: Even small victories, like skipping Starbucks twice a week, deserve recognition.

Bonus Tip: Avoid the temptation to micromanage your client’s spending. Trust me, hovering over them like a hawk leads to rebellion faster than you can say “avocado toast.”

Image: Visual breakdown of SMART goals applied to budget examples.

Step 3: Real-Life Budget Examples That Work

Let’s move beyond theory. Below are three battle-tested budget examples that work wonders for different lifestyles:

Example 1: Freelancer’s Irregular Income Budget

- Income: $3,000/month average

- Essentials: Rent ($1,200), Utilities ($200)

- Savings: Emergency Fund ($500)

- Variable Expenses: Groceries ($400), Entertainment ($200)

Example 2: Family Budget with Two Kids

- Income: $6,000/month

- Essentials: Mortgage ($2,000), School Fees ($800)

- Savings: College Fund ($600)

- Fun Money: Vacations ($300)

Example 3: Student Life Minimalist Budget

- Income: $800/month part-time job

- Essentials: Rent ($400), Food ($200)

- Savings: Travel dreams ($100)

- Flex Spending: Hangouts ($50)

Rant Section: Why “Save 5%” Advice is Lazy

Tell me if this sounds familiar: “Just save 5% of your income.” Oh, okay, genius—like anyone struggling financially has wiggle room for arbitrary percentages. Instead of tossing out lazy blanket statements, dig deeper. What does *your specific audience* need? Tailored solutions beat cookie-cutter nonsense any day.

FAQs About Budget Examples & Coaching Apps

Q: Do I really need a coaching app to create a budget?

Absolutely not. But let’s face it—apps make life easier. They automate repetitive tasks and keep you accountable. Think of them as your digital cheerleader minus the pom-poms.

Q: Which budget example should I start with?

It depends on your lifestyle and goals. Start simple, then adjust based on trial and error. And hey, don’t forget to tweak periodically—it’s like tending to your Tamagotchi, but less pixelated.

Conclusion

To recap, budget examples paired with effective coaching apps transform financial coaching into a powerful tool for change. Remember, simplicity wins. Choose apps wisely, guide clients through actionable steps, and celebrate progress along the way.

P.S. Like a Tamagotchi, your SEO needs daily care too. Keep nurturing those budgets!