Ever stared at your bank account on payday and wondered where all the money went? Yeah, us too. Budgeting feels impossible when you’re drowning in subscriptions you forgot about or impulse buys that seemed “totally necessary.” But what if we told you there’s a way to simplify this chaos—without hiring a finance guru?

Welcome to your guide on using budgeting for beginners template through coaching apps! In this article, you’ll learn how to kickstart financial literacy without pulling out your hair. We’ll cover why most budgeters fail early on (ouch), step-by-step instructions to create an actionable template, top tips from pros, and real-life examples of people who crushed their budgets. Oh, and did I mention ranting about poorly designed templates? Let’s dive in.

Table of Contents

- Key Takeaways

- Why Most Budgets Fail Before They Start

- How to Use a Budgeting for Beginners Template

- Top Tips for Success

- Real-Life Stories That Inspire

- Frequently Asked Questions

- Conclusion

Here Are the Key Takeaways

- A budgeting for beginners template acts as your financial GPS.

- Coaching apps make sticking to your budget easier by gamifying progress.

- The biggest mistake beginners make is overcomplicating things—keep it simple.

- Consistency beats perfection; small wins add up over time.

Why Most Budgets Fail Before They Start

I once tried creating my own budgeting sheet in Excel—it was glorious. It had colors, charts, formulas… but also zero understanding of reality. After three days, I abandoned it entirely because life happened faster than I could update cells. Sound familiar?

Let’s be brutally honest here: most people don’t stick to budgets because:

- They’re boring AF.

- They’re overwhelming AF.

- No one taught them *how* to use one effectively.

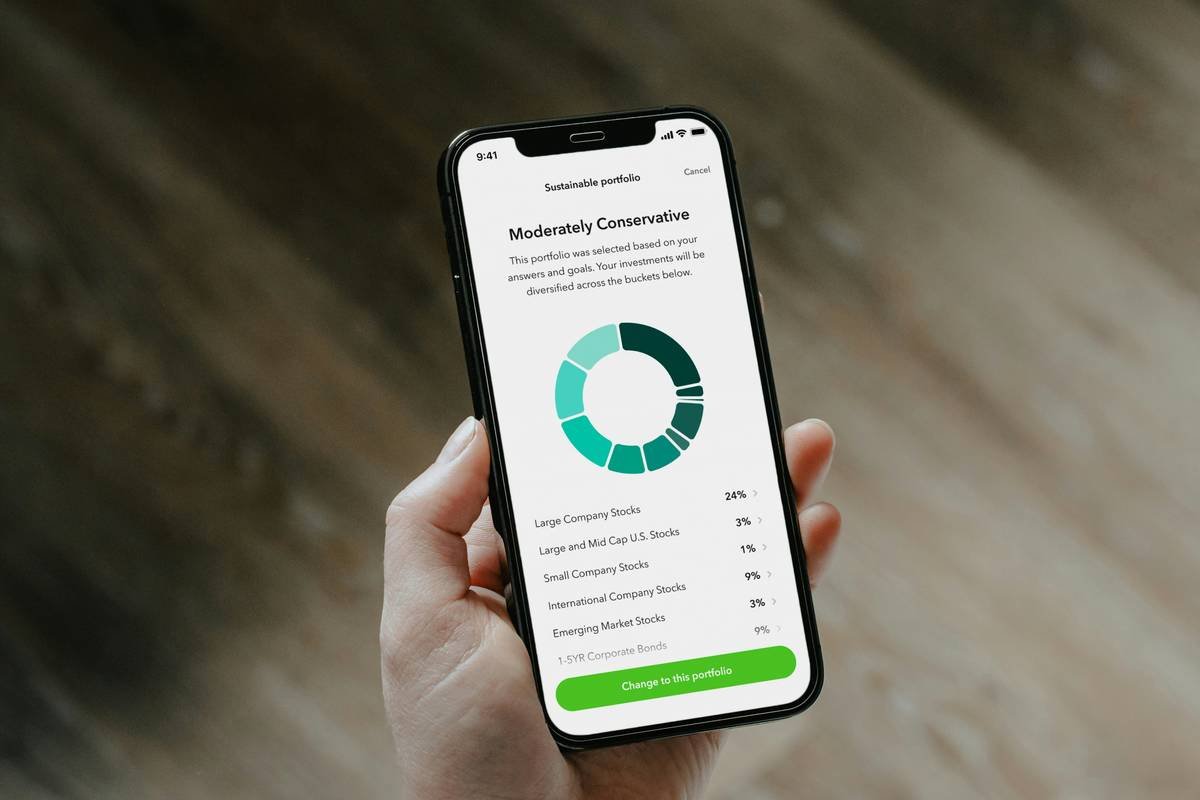

Enter coaching apps. These tools combine personal finance education with interactive features like spending trackers, notifications, and even rewards. Think Duolingo for dollars—but chef’s kiss for drowning debt algorithms.

How to Use a Budgeting for Beginners Template

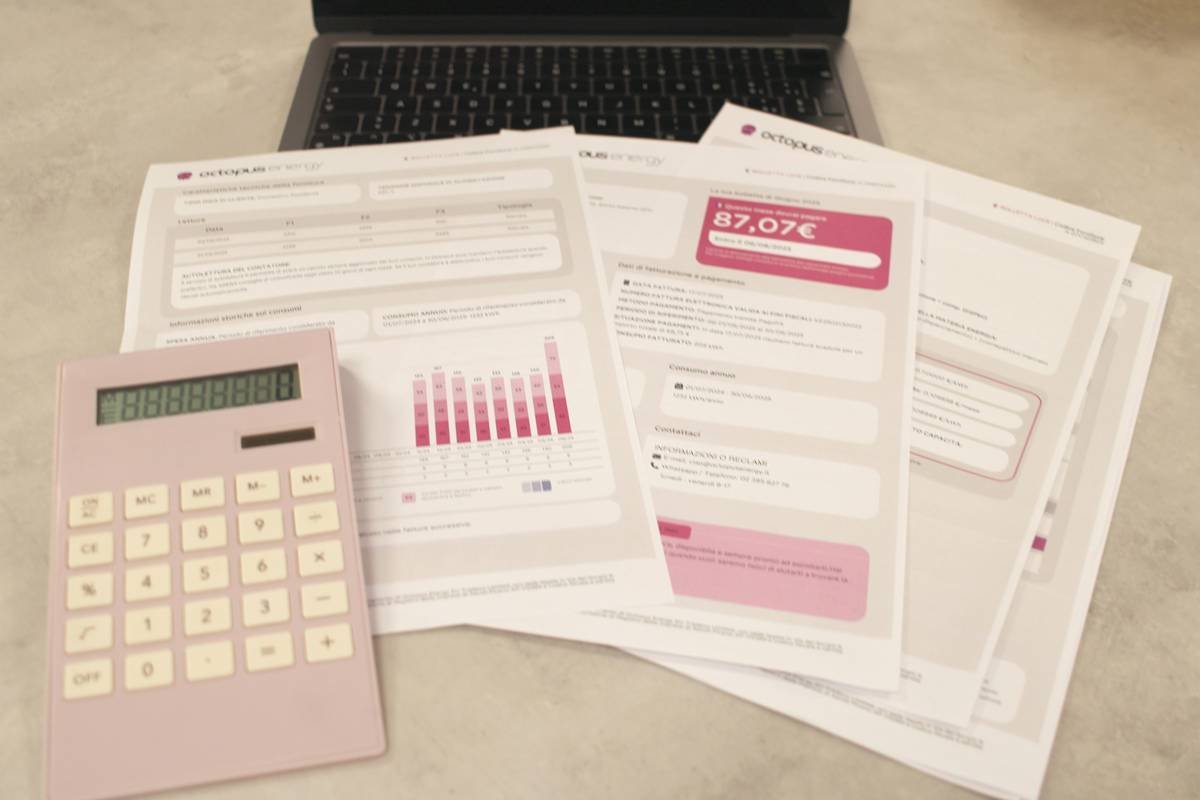

Step 1: Assess Your Current Financial Situation

“Optimist You:” “This won’t take long!”

Grumpy You: “Ugh, fine—but only if coffee’s involved.” *

Start by reviewing your income sources (salary, side gigs) and expenses (rent, groceries). Write down EVERYTHING—even that $2 latte habit.

Step 2: Choose a Coaching App

Select an app tailored to newbies. Some popular options include Mint, YNAB (You Need A Budget), and PocketGuard. Look for ones offering pre-built templates under their settings menu.

Step 3: Customize the Template

Tweak default categories in your budgeting for beginners template based on YOUR lifestyle. For instance:

- Eat out often? Add “Dining Out”.

- Paying off loans? Include “Debt Repayment Goals”.

Step 4: Automate and Track

Link your accounts (safely encrypted!) so transactions appear automatically. Then, check weekly updates to see how close you are to hitting goals.

Top Tips for Success

- Overestimate Expenses: Always round UP when estimating monthly costs. Better safe than sorry!

- Mix Fun & Function: Allocate 5% of your budget strictly for fun activities. Deprivation leads to binges later.

- Automate Savings: Set up automatic transfers to savings whenever you get paid—it’s painless magic.

- [WARNING] Avoid Too Many Tools: Don’t download five different apps thinking more tech = better results. Spoiler: It doesn’t.

Real-Life Stories That Inspire

Jessica, a freelance graphic designer, used her first budgeting for beginners template via YNAB. She saved over $7,000 within eight months by cutting unnecessary subscriptions and meal planning. Her secret? Sticking to the same grocery list every week. Boring yet brilliant.

Another user, Mark, credits his debt-free journey to PocketGuard’s visual charts. Seeing daily balances decrease motivated him beyond traditional spreadsheets ever could.

Frequently Asked Questions

Do I Need Prior Knowledge to Use Coaching Apps?

Nope! Most platforms guide rookies step by step. Remember: Everyone starts somewhere.

Can I Still Use Paper Instead of Digital Solutions?

Sure…if medieval scrolls float your boat. Jokes aside, digital tools save tons of time, especially syncing banks instantly.

What If I Mess Up My First Month’s Budget?

Congrats—you just joined the club. Adjust, adapt, and try again next month. Rome wasn’t built in a day.

Conclusion

Budgeting isn’t rocket science—it’s habit-building wrapped in practicality. By leveraging a budgeting for beginners template paired with powerful coaching apps, anyone can master personal finance sans stress. So grab your phone, open an app, and start tracking those dollars. You got this.

And remember, like a Tamagotchi from the early 2000s, your budget needs daily care—not occasional panic feeds. Happy saving!