Hook: Ever stared at your debt progress reports, feeling overwhelmed and unsure if you’re even making a dent? Yeah, we’ve been there too.

If you’re juggling personal finance chaos, this post is your lifeline. We’ll explore how coaching apps can help you take control of your debt progress reports, improve financial literacy, and crush those money goals with laser focus. Expect actionable tips, brutal honesty about common mistakes, and some “aha!” moments you didn’t know you needed.

Table of Contents

- The Problem with Traditional Debt Tracking

- How Coaching Apps Revolutionize Debt Progress Reports

- Tips for Maximizing Coaching Apps

- Real-World Success Stories

- Frequently Asked Questions

Key Takeaways

- Coaching apps streamline the creation and tracking of debt progress reports.

- They combine education, accountability, and tools to simplify complex financial tasks.

- Avoid generic advice—use these strategies tailored specifically for modern learners.

Why Are Your Debt Progress Reports So Annoying?

Let me tell you a story: I once tried to create my own debt progress report using nothing but Excel. It was like trying to build IKEA furniture without instructions—a headache-inducing mess of formulas, outdated data, and tears. Does that sound familiar?

Here’s the ugly truth: traditional methods don’t cut it anymore. Spreadsheets lack real-time updates. Pen-and-paper trackers get lost under piles of bills. And guess what? Most people have zero idea where they stand because they give up halfway through organizing everything.

Add in the fact that many struggle to understand financial jargon (yep, guilty!) or lack motivation when results feel distant—it’s easy to see why debt management feels impossible.

“Optimist You:” ‘I’ll figure it out on my own!’ Grumpy Me: ‘Sure…or just use an app and save yourself decades of misery.'”

How Coaching Apps Help You Ace Your Debt Progress Reports

Step 1: Automate Data Collection

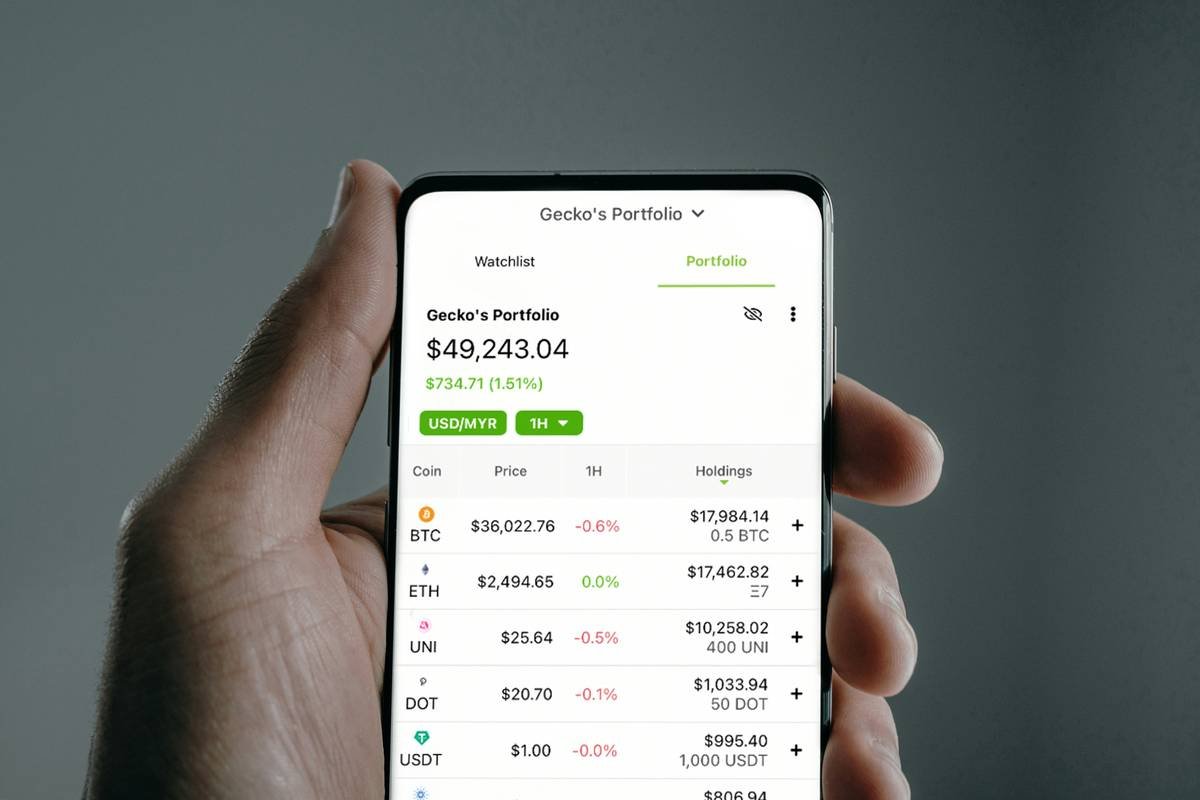

Gone are the days of manually entering transactions into spreadsheets. Leading coaching apps sync directly with your bank accounts, credit cards, loans—you name it. This means your debt progress report updates automatically every time you make a payment or incur a charge.

Step 2: Visualize Your Progress

No more staring blankly at rows of numbers. With intuitive charts and graphs, coaching apps turn boring stats into something visual—even motivating. Watching that bar chart inch closer to “paid off” gives you clarity and momentum.

Step 3: Gamify Your Goals

Some apps add game-like challenges or rewards for paying down balances faster. Think streak bonuses for consistent payments or milestones that unlock celebratory badges. Who knew conquering debt could feel so fun?

Step 4: Access Educational Resources

The best apps go beyond basic reporting by offering built-in courses, articles, or videos. Learning budgeting basics or advanced investing tips alongside your debt progress reports? Chef’s kiss.

Step 5: Stay Accountable

Ever promised yourself you’d stop buying coffee daily but failed miserably? Enter accountability features like reminders, goal-sharing options, and coach check-ins. These ensure you stay focused on crushing your debt journey.

Best Practices for Making Coaching Apps Work for You

- Set Clear Milestones: Break your total debt into manageable chunks (e.g., Pay $1,000 in three months).

- Review Weekly: Don’t become a stranger to your app. Regular reviews keep you invested.

- Learn Continuously: Explore courses offered within the app. Knowledge empowers smarter decisions.

- Avoid the DIY Trap: Stop trying to reinvent the wheel. Trust the experts behind the app.

RANT: Why do people insist on ignoring automation when it comes to finance? Like, seriously! If there’s one area where tech saves hours AND reduces stress, it’s here. Ditch the stubbornness already!

Success Stories: Real People Crushing Their Debt

Sarah’s Story: After graduating college with $25K in student loans, Sarah felt stuck. She started using a top-rated coaching app that offered personalized recommendations and micro-courses. In just 18 months, she paid off all her debt. Her secret sauce? Using the app’s debt progress reports to celebrate small wins weekly.

John & Lisa’s Turnaround: A married couple drowning in $50K of combined credit card and medical debt saw light at the end of the tunnel thanks to shared access to their app’s interactive reports. They set joint goals and held each other accountable through virtual coaching sessions.

FAQs About Debt Progress Reports and Coaching Apps

Are coaching apps really worth the investment?

Yes! Many users find that the efficiency gained—and future savings earned—far outweigh subscription costs.

Can I trust these apps with my sensitive financial info?

Totally. Reputable apps use bank-level encryption and comply with strict security protocols. Just read reviews first!

What if I fall off track?

Most apps offer forgiveness programs, refresher courses, and community support groups to help you bounce back.

Conclusion

Coaching apps aren’t magic pills—they’re practical tools designed to empower YOU to conquer debt intelligently. From automating tedious tasks to providing crystal-clear debt progress reports, they level up your financial game big time. So, whether you’re drowning in student loans or battling credit card interest, let technology be your ally.

Remember: Small steps lead to giant leaps. Download an app today, and start seeing those numbers shrink!

Like Pikachu leveling up, your debt-free journey begins now.

Haiku Bonus:

Debt weighs heavy still,

Progress reports show the path.

Freedom waits ahead.