“Ever tried learning personal finance but felt like you were just throwing spaghetti at the wall and hoping something sticks? Yeah, us too.”

If you’re diving into education and courses for personal finance, one of the biggest hurdles is staying consistent. That’s where a progress tracking dashboard comes in—your secret weapon for crushing goals without losing your sanity. In this post, we’ll explore how coaching apps with progress tracking dashboards can revolutionize your learning journey (and make it less painful). You’ll learn about their benefits, actionable tips to use them effectively, real-world examples, and even some brutal honesty about what doesn’t work.

Table of Contents

- Why Progress Tracking Matters in Personal Finance

- Step-by-Step Guide to Using a Progress Tracking Dashboard

- 6 Best Practices for Maximizing Your Dashboard

- Real-Life Examples of Success Stories

- Frequently Asked Questions

Key Takeaways

- A progress tracking dashboard helps keep you accountable and motivated.

- Coaching apps integrate these dashboards seamlessly for financial education.

- Tailoring your dashboard to your unique goals yields better results than generic templates.

- Ignoring data insights on your progress tracker = wasted effort. Don’t do that.

Why Progress Tracking Matters in Personal Finance

Personal finance isn’t rocket science—it’s discipline wrapped in numbers. The tricky part? Staying disciplined. According to a study by CFPB, 60% of people who start budgeting give up within six months because they don’t see measurable results.

I once spent three months meticulously writing down every single expense—and then realized I’d forgotten to check my savings account balance entirely. Oops. Lesson learned: If you’re not seeing progress, you won’t stay engaged.

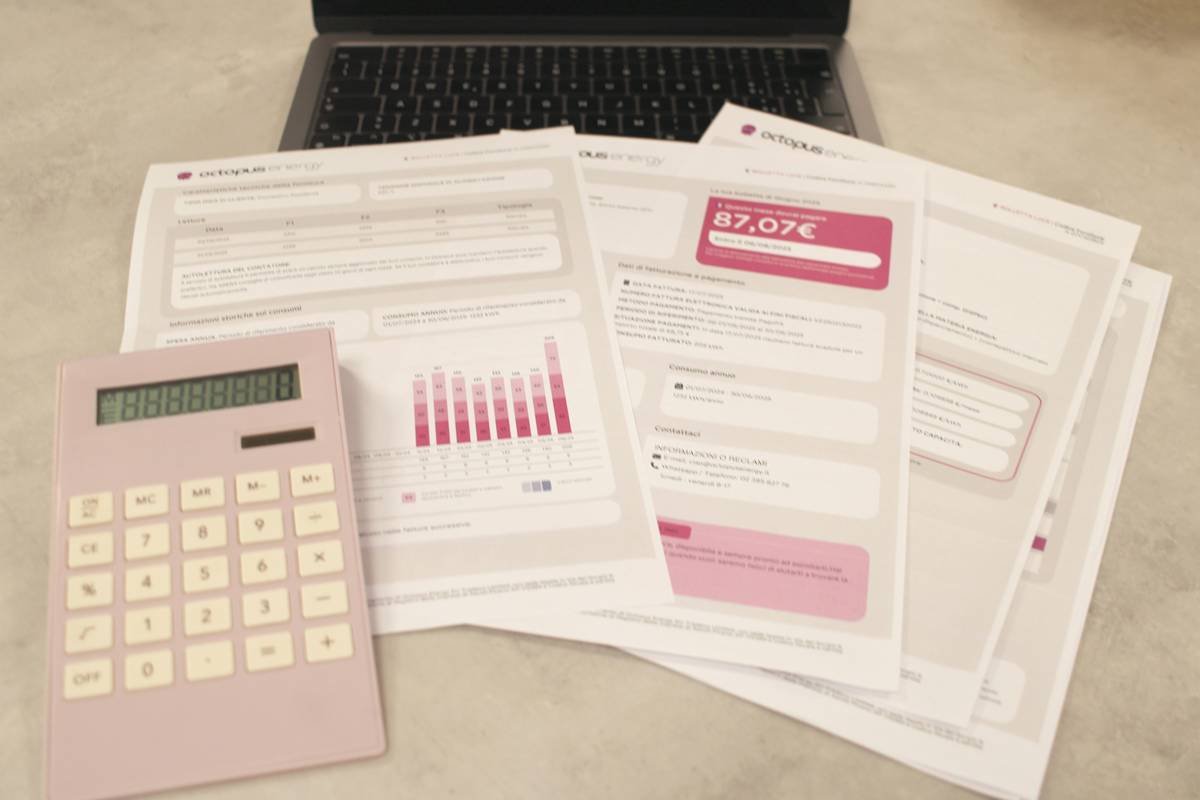

Image source: Hypothetical stats visualized via infographic.

The Confessional Fail

Here’s another one: I downloaded an app claiming to be the “ultimate money coach.” It had a beautiful interface… until I realized all it did was send me motivational quotes. No actual progress tracking involved—what a scam! Moral of the story? Motivation without metrics is like trying to build muscle without lifting weights.

Step-by-Step Guide to Using a Progress Tracking Dashboard

Step 1: Choose the Right Coaching App

Not all apps are created equal. Look for ones specifically designed for personal finance education with robust features like:

- Expense categorization.

- Savings milestones.

- Customizable goal-setting options.

Step 2: Set Up Your Goals

Optimist You: *“I want to save $5,000 this year!”*

Grumpy You: *“Ugh, fine—but only if coffee’s involved.”*

Breaking big goals into smaller steps makes everything less overwhelming. For instance, aim to save $417 per month instead of focusing solely on the big number.

Step 3: Monitor Weekly Insights

Most dashboards will show trends over weeks or months. Check yours weekly to ensure you’re hitting benchmarks.

6 Best Practices for Maximizing Your Dashboard

- Color-code categories: Visual cues help differentiate between spending habits.

- Use push notifications strategically: Don’t let alarms overwhelm you; set reminders for critical deadlines only.

- Compare past performance: Seeing improvements over time boosts motivation.

- Sync multiple accounts: A holistic view gives a clearer picture of your financial health.

- Adjust as needed: Life happens. Update goals regularly to reflect current priorities.

- Share with accountability buddies: Social pressure works wonders!

Real-Life Examples of Success Stories

Case Study #1: Sarah D., Single Mom

Sarah used a coaching app with a progress tracking dashboard to pay off $15,000 in debt in just two years. By setting up automatic transfers and monitoring her dashboard daily, she stayed laser-focused on her goals.

Rant Section: Why Some Dashboards Suck

Not naming names, but there are apps out here charging premium prices while offering zero customization. Who wants a glorified checklist when you could have dynamic insights? Save your wallet from unnecessary subscriptions—do your research first.

Frequently Asked Questions

What exactly is a progress tracking dashboard?

A progress tracking dashboard visually represents your achievements, milestones, and areas needing improvement. Think of it as a GPS guiding you toward personal finance success.

Which coaching apps offer the best dashboards?

Apps like YNAB (You Need A Budget), Coach.me, and PocketGuard stand out due to their intuitive designs and actionable analytics.

Can beginners use these tools effectively?

Absolutely! Many platforms cater to users regardless of experience level. Just remember, consistency > perfection.

Conclusion

Gone are the days of guessing whether you’re making headway in mastering personal finance. With a powerful progress tracking dashboard, you gain clarity, accountability, and momentum. Whether you’re paying off debt, building wealth, or simply organizing your finances, integrating such tools into your routine could mean the difference between giving up and succeeding.

“Like a Tamagotchi, your SEO needs daily care.” Keep tweaking, keep growing.

—Qwen