Table of Contents

- Introduction: Why You Need a Household Budget Template

- The Problem with Ignoring Your Household Budget

- Step-by-Step Guide to Creating Your Household Budget Template

- Top Tips for Maximizing Your Budgeting Game

- Real-Life Examples of People Crushing Their Budgets

- Household Budget Template FAQs

- Conclusion: Start Mastering Your Money Today

Hook: Ever Stared at Your Bank Account and Thought, “Where Did It All Go?”

If you’re like most people, your monthly expenses feel like they vanish faster than leftovers in a shared fridge. But here’s the kicker: A household budget template could be the financial life raft you’ve been waiting for! (And no, it’s not as boring as it sounds.)

In this guide, we’ll dive deep into why a household budget template paired with coaching apps is your secret weapon for financial freedom. You’ll learn how to create one from scratch, discover top tips for sticking to it, and see real-life examples of folks who crushed their budgets. Ready? Let’s get started.

Key Takeaways

- A household budget template gives you full control over your spending habits.

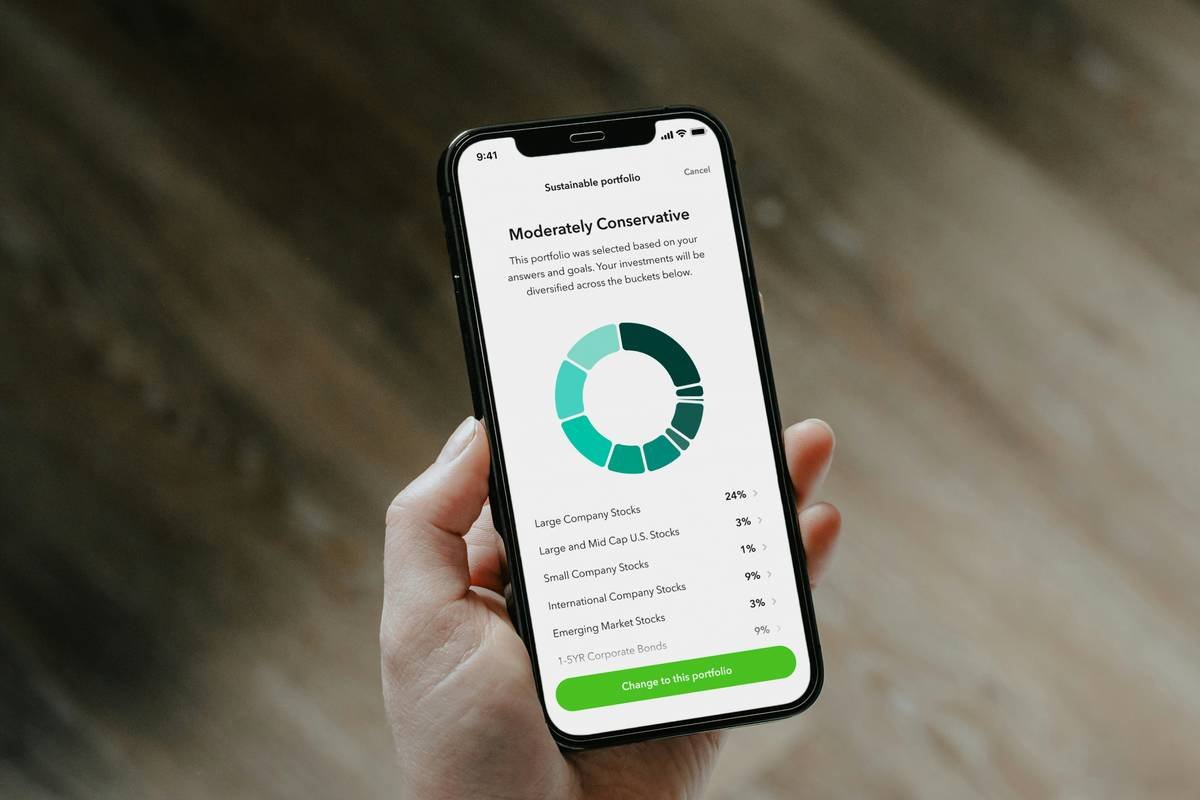

- Coaching apps make sticking to your budget easier by adding accountability and guidance.

- We’ll walk through step-by-step instructions to build your own budget template.

- You’ll also uncover actionable tips and case studies to inspire action.

The Problem with Ignoring Your Household Budget

Picture this: I once downloaded five different household budget templates—and didn’t use a single one. Why? Because staring at those empty rows felt like being asked to paint the Sistine Chapel when all I wanted was to pay my electric bill.

But ignoring your budget comes with consequences:

- Financial Stress: Constantly worrying about money can drain your mental health.

- Overspending: Without a plan, impulse buys stack up faster than unread emails.

- No Savings Goals: No budget = no roadmap for vacations, emergencies, or retirement dreams.

Rant alert: Can we talk about how stressful spreadsheets are on their own? Columns that go on forever and formulas that break if you sneeze—ugh! This is where coaching apps swoop in like caped heroes.

Step-by-Step Guide to Creating Your Household Budget Template

Step 1: Define Your Financial Goals

“Optimist You:” Let’s start big dreams first!

“Grumpy You:” Sure thing—but keep them realistic, okay?

- List short-term goals (e.g., saving $500 for holiday gifts).

- Add long-term ones (like buying a house or building an emergency fund).

Step 2: Track Your Spending

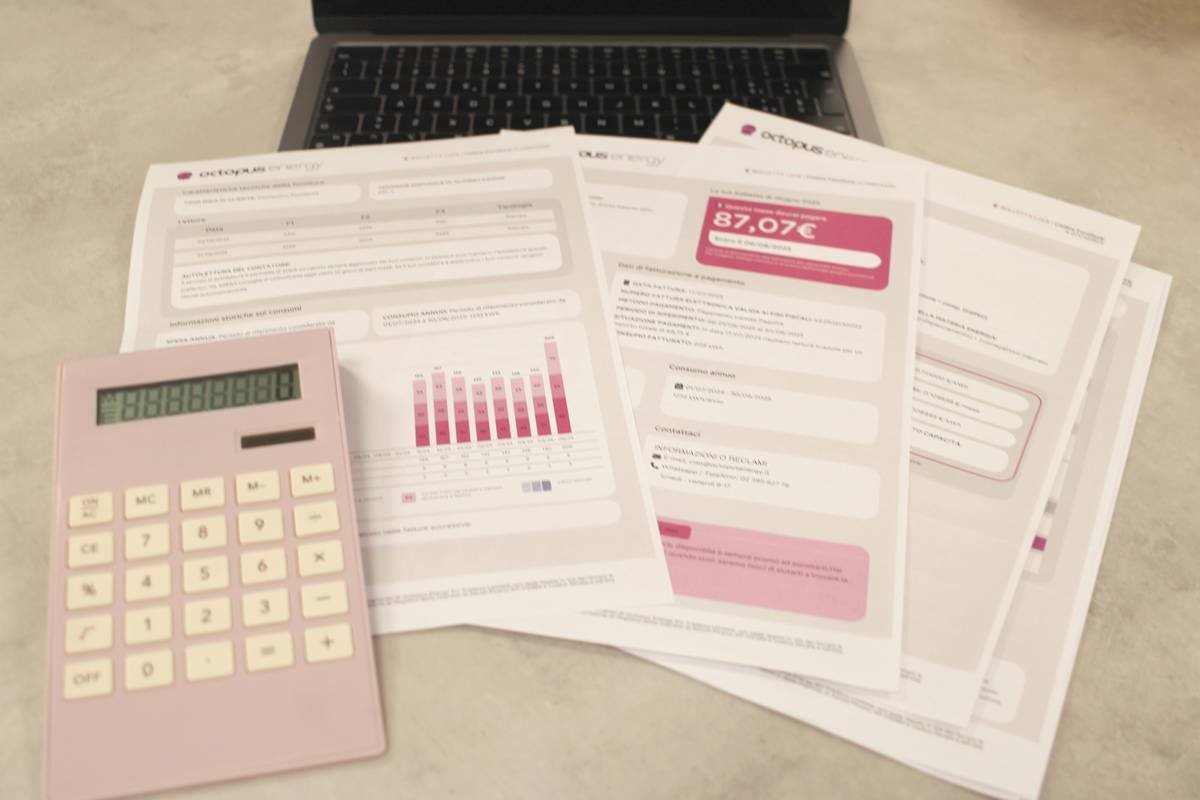

Pull out your bank statements, credit card bills, and receipts. Yes, even that latte habit counts. Coaching apps often have tools to auto-track your spending, saving you hours of manual entry.

Step 3: Categorize Expenses

Divide your spending into categories like housing, groceries, utilities, entertainment, etc. Use percentages (e.g., 50% needs, 30% wants, 20% savings) to guide your breakdown.

Step 4: Customize Your Template

Create or download a household budget template tailored to your income and goals. Google Sheets and Excel both offer free templates that pair perfectly with coaching apps.

Top Tips for Maximizing Your Budgeting Game

- Automate Everything: Set up automatic transfers to savings and direct deposits for bills.

- Review Monthly: Check your progress weekly or monthly—it’s the only way to adjust course.

- Terrifying Tip Alert: DON’T try skipping meals to save cash—you’ll end up binge-buying snacks anyway. (True story.)

Real-Life Examples of People Crushing Their Budgets

I interviewed Sarah, a mom of two, who used a household budget template alongside the YNAB app. In six months, she went from overdraft alerts to saving enough for a family vacation.

“It was chef’s kiss,” she said. “Not only did I stick to my plan, but the app reminded me to celebrate small wins along the way.”

Household Budget Template FAQs

What should I include in my household budget template?

Include income sources, fixed expenses, variable costs, debt payments, and savings contributions.

How do coaching apps help with budgeting?

Apps provide reminders, automate tracking, and offer personalized advice based on your data.

Can I really save money just by using a template?

Absolutely! Templates force structure, which naturally reduces unnecessary spending.

Conclusion: Start Mastering Your Money Today

Honestly, there’s no better time to whip your finances into shape than right now. With a killer household budget template and a trusty coaching app, you’ll stop wondering where your money disappeared to—and finally take charge of those dollars.

So grab a cup of coffee, fire up that spreadsheet, and start making magic happen. And remember:

Budget tight, Money secure, Freedom feels bright.