Ever stared at your bank account, wondering where all the money went? You’re not alone. Studies show that 60% of Americans live paycheck to paycheck, often without a clear idea of their spending habits. But here’s the kicker: creating an expense budget template could save you from financial chaos—and yes, even coaching apps are getting in on this life-saving strategy.

In this post, we’ll explore how using an expense budget template can transform your personal finance game while integrating seamlessly with popular coaching apps. You’ll discover actionable steps, insider tips, and real-world examples to guide you along the way. Plus—spoiler alert—we’ll vent about those pesky “free trial scams” hiding in plain sight!

Table of Contents:

- Why You Need an Expense Budget Template

- How to Create Your Own Expense Budget Template

- Top Tips for Using Coaching Apps with a Budget Template

- Real-Life Success Stories

- FAQ About Expense Budget Templates

Key Takeaways:

- An expense budget template helps organize and track expenses effectively.

- Coaching apps can enhance budgeting by offering accountability and insights.

- User-friendly templates are essential for sustaining long-term financial habits.

- Avoid free trials disguised as tools—they might just complicate things further.

Why You Need an Expense Budget Template

I once tried tracking my expenses manually—a spiral notebook, highlighters, and sheer determination. By the end of week one, I gave up because sorting through receipts felt like untangling headphones after they’d been shoved into a bag. Sound familiar?

If so, it’s time to embrace technology—or more specifically, an expense budget template paired with coaching apps. These templates provide structure, making it easier to categorize spending under sections like groceries, rent, entertainment, etc. And guess what? Many coaching apps love them too since they integrate effortlessly to boost productivity.

Not convinced? Imagine never overspending again. An expense budget template is basically the adulting cheat code everyone needs.

How to Create Your Own Expense Budget Template

*Optimist You*: “Let’s build a rock-solid budget!”

*Grumpy You*: “Ugh, fine—but only if coffee’s involved.”

- Gather Data: Start by reviewing your income sources and fixed expenses (rent, utilities, subscriptions).

- Choose Tools: Pick Google Sheets, Excel, or any budgeting tool compatible with coaching apps.

- Set Categories: Break down expenses into categories such as housing, food, transportation, savings, and discretionary spending.

- Add Formulas: Automate calculations for total spending vs. income balance.

- Synchronize with Apps**): Connect your template to apps like PocketGuard or YNAB via integrations.

This step-by-step process ensures you don’t miss anything critical. Think of it as leg day for your wallet—it hurts initially but pays off big-time later.

Top Tips for Using Coaching Apps with a Budget Template

TIP #1: Track Your Progress Daily

Consistency is key! Log transactions every day to avoid forgetting random purchases (hello, $7 latte). Most coaching apps send reminders to keep you accountable.

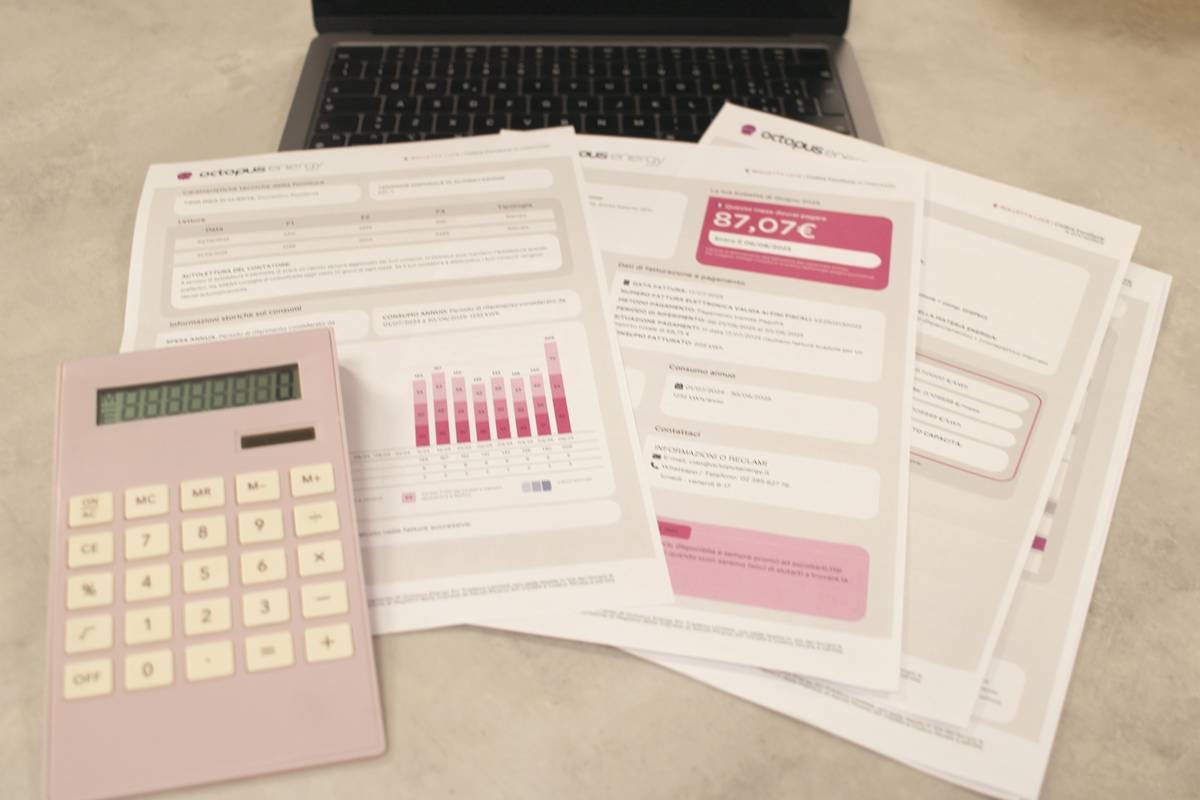

TIP #2: Leverage Visual Reports

Seeing colorful pie charts showing where your money goes? Chef’s kiss. This feature turns dry numbers into engaging visuals that motivate smarter decisions.

(Terrible Tip Warning) TIP #3: Don’t Rely Solely on Free Trials

Sure, signing up for a “FREE TRIAL” sounds great until you realize they auto-bill you after two weeks. Always check cancellation policies first. 🙄

TIP #4: Personalize Notifications

Some apps let you customize alerts. For instance, set notifications when you hit 90% of your dining-out budget—preventing last-minute splurges.

Real-Life Success Stories

Meet Sarah, a freelance designer who struggled to manage her irregular income streams. After adopting an expense budget template linked to her favorite coaching app, she cut impulsive shopping sprees by 70%. Her secret sauce? A simple rule—”if it doesn’t spark joy AND fit the budget, don’t buy it.”

Another success story comes from Jake, a college student drowning in loan debt. With automated reminders to stick to his grocery budget, he saved enough to pay off $5K within six months. Talk about crushing goals!

FAQ About Expense Budget Templates

Q: Do I need advanced Excel skills?

A: Nope! Plenty of pre-built templates exist online, ready for immediate use.

Q: What’s better—Google Sheets or Excel?

A: Both work wonders. Choose based on whether you prefer cloud storage (Google) or offline access (Excel).

Q: Can these really help me save money?

A: Absolutely. Seeing hard data forces smarter spending choices. It’s psychology meets finance.

Conclusion

Congratulations—you now know how powerful combining an expense budget template with coaching apps can be! From automating tedious tasks to visualizing progress, there’s no excuse left to dodge budgeting anymore.

Remember: Start small, stay consistent, and let technology amplify your efforts. And hey, don’t forget your daily dose of coffee when diving deep into spreadsheets!

Like a Tamagotchi, your finances thrive on care—so nurture them wisely. 🌱💸