Ever stared at your bank account, wondering where all your money went? Yeah, us too. It’s like trying to track a ninja—except the ninja is your unnecessary subscriptions and impulse coffee buys. What if there was a way to make your spending as transparent as your ex’s Instagram stories? Enter coaching apps that provide detailed budget reports. In this post, we’ll explore how these apps can revolutionize your financial game and teach you exactly what you need to know.

Here’s what you’ll learn:

- The importance of detailed budget reports in personal finance education.

- Step-by-step guide on using coaching apps effectively.

- Tips for maximizing your app experience (and avoiding rookie mistakes).

- Real-world success stories proving these tools work wonders.

Table of Contents

- Key Takeaways

- Why You Need Detailed Budget Reports

- How to Use Coaching Apps for Financial Success

- Best Practices for Maximizing Your App’s Potential

- Success Stories: Real People, Real Results

- FAQs About Coaching Apps and Budgeting Tools

Key Takeaways

- Detailed budget reports are your secret weapon for financial clarity.

- Coaching apps make managing finances easier by automating data tracking.

- Consistency is key—update your reports regularly to stay on top of your goals.

Why You Need Detailed Budget Reports

I once tried budgeting without any tools or structure. Spoiler alert: it ended with me eating ramen noodles three nights in a row while crying over my credit card statement. The problem wasn’t my lack of discipline—it was my lack of visibility into where my money was going. Enter detailed budget reports, which transform chaotic spending habits into actionable insights.

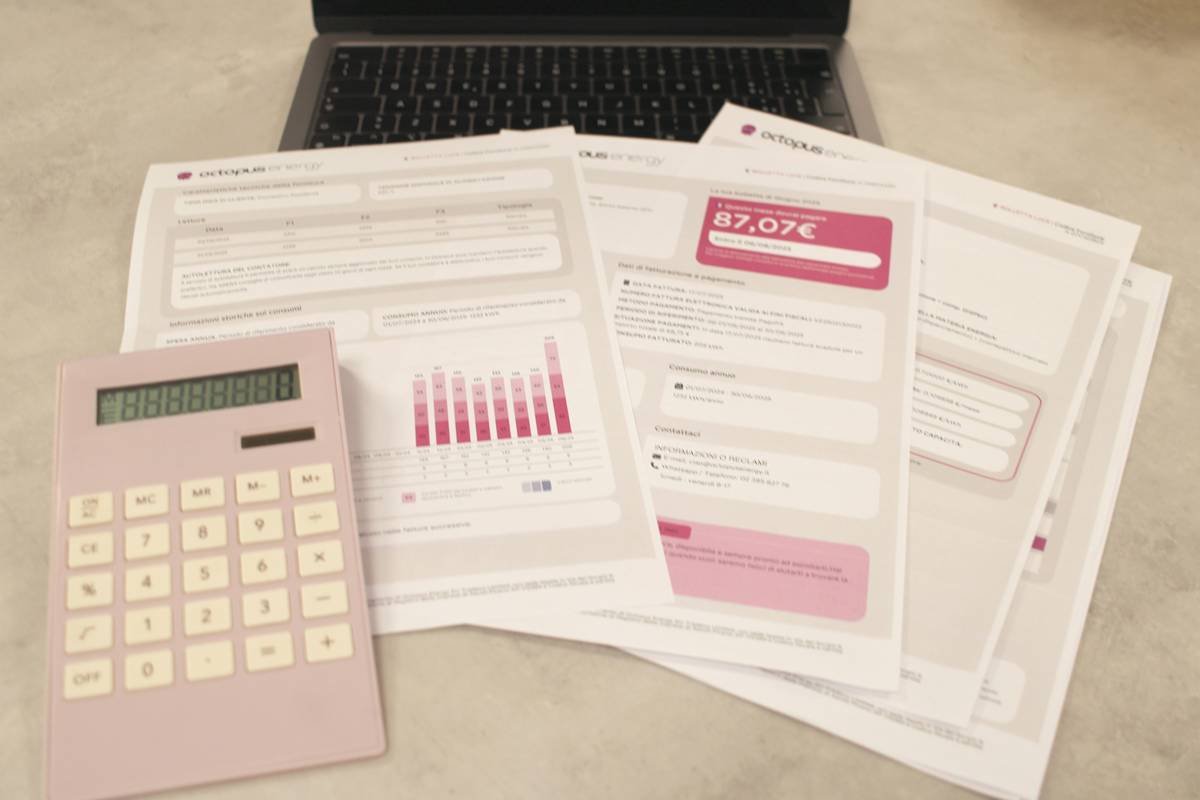

Imagine logging into an app that tells you things like:

“You spent 70% more on dining out last month compared to the average user.”

Sounds like your laptop fan during tax season—whirrrr—but trust me, it works. These visual breakdowns let you identify areas to cut back, saving both time and money. Plus, they’re chef’s kiss for anyone trying to educate themselves about smart financial practices through structured courses within the same ecosystem.

How to Use Coaching Apps for Financial Success

Optimist You: “This sounds amazing! How do I start?”

Grumpy You: “Ugh, fine—but only if coffee’s involved.”

Fair enough. Here’s the step-by-step process:

Step 1: Choose the Right Coaching App

Not all apps are created equal. Look for one offering robust features like income categorization, goal setting, and—you guessed it—detailed budget reports. Apps such as PocketGuard, Mint, or YNAB (You Need A Budget) are great starting points.

Step 2: Sync Your Accounts

Scary? Yes. Necessary? Absolutely. Syncing your accounts ensures every transaction gets tracked automatically. No manual input means fewer chances for errors—or excuses not to log expenses.

Step 3: Set Financial Goals

No GPS system takes you anywhere without a destination. Whether it’s paying off debt, building savings, or funding your dream vacation, specific targets help motivate consistent reporting and adjustments.

Best Practices for Maximizing Your App’s Potential

- Review Weekly: Don’t wait until the end of the month. Regular check-ins keep surprises at bay.

- Categorize Wisely: Proper tags prevent pizza from being mistaken for groceries (I’m looking at you, frozen pepperoni).

- Avoid Overcomplicating: Start simple. Too many categories = less focus. Keep it straightforward unless you’re a spreadsheet wizard.

Now, here’s a terrible tip no one asked for: Try guessing all your expenses instead of relying on actual data. Spoiler: You will fail miserably. Rant moment: Why do people still think eyeballing their finances works?!

Success Stories: Real People, Real Results

Jane, a freelance graphic designer living paycheck to paycheck, downloaded a coaching app after hearing its praises online. By leveraging detailed budget reports, she slashed her nonessential spending by 30% in just two months. Her secret combo? Automating expenses and reviewing weekly reports religiously.

Another case: Mark, a recent college graduate drowning in student loans, used his app’s educational modules alongside personalized budget plans. Within six months, he’d paid down $5k worth of debt—all thanks to newfound understanding via app analytics.

FAQs About Coaching Apps and Budgeting Tools

Can I use multiple coaching apps simultaneously?

While possible, overlapping platforms might confuse your data flow. Stick to one powerhouse tool initially.

Are coaching apps safe for sensitive financial info?

Reputable apps employ bank-level encryption. Still, always review privacy policies before syncing accounts.

Will these apps fix my finances overnight?

Nice try. While apps simplify management, true financial transformation requires commitment and behavior changes.

Conclusion

To sum up, detailed budget reports provided by coaching apps offer unparalleled insight into your spending habits, helping you gain control over even the trickiest financial puzzles. From choosing the right app to maintaining disciplined weekly reviews, small steps add up to big wins over time. So, go ahead—be the financial ninja you were born to be.

Like a Tamagotchi, your SEO needs daily care.