Table of Contents

- Introduction

- Key Takeaways

- Why Do You Need a Simple Budget Planner?

- Step-by-Step Guide to Using Coaching Apps for Budgeting

- Pro Tips for Maximizing Your Simple Budget Planner

- Real-Life Wins: How Coaching Apps Transformed Finances

- Frequently Asked Questions About Simple Budget Planners

- Conclusion

Introduction

Ever felt like your wallet was on an endless diet, but you weren’t sure why? You’re not alone. Studies show that nearly 60% of people struggle to stick to a budget despite knowing it’s crucial for financial health. Now, imagine if managing money didn’t feel like wrestling a greased pig—enter coaching apps and the mighty simple budget planner. In this post, we’ll uncover how these tools make personal finance less “ugh” and more “aha!” By the end, you’ll understand:

- Why budgeting can be simple (not soul-sucking).

- The top coaching apps designed for effortless planning.

- A step-by-step roadmap to mastering your spending.

Key Takeaways

- A simple budget planner helps you track expenses without overcomplicating things.

- Coaching apps offer hands-on support tailored to your unique goals.

- You don’t need spreadsheets or finance degrees; just consistency and the right tool.

- Automation is your new best friend in sticking to budgets long-term.

Why Do You Need a Simple Budget Planner?

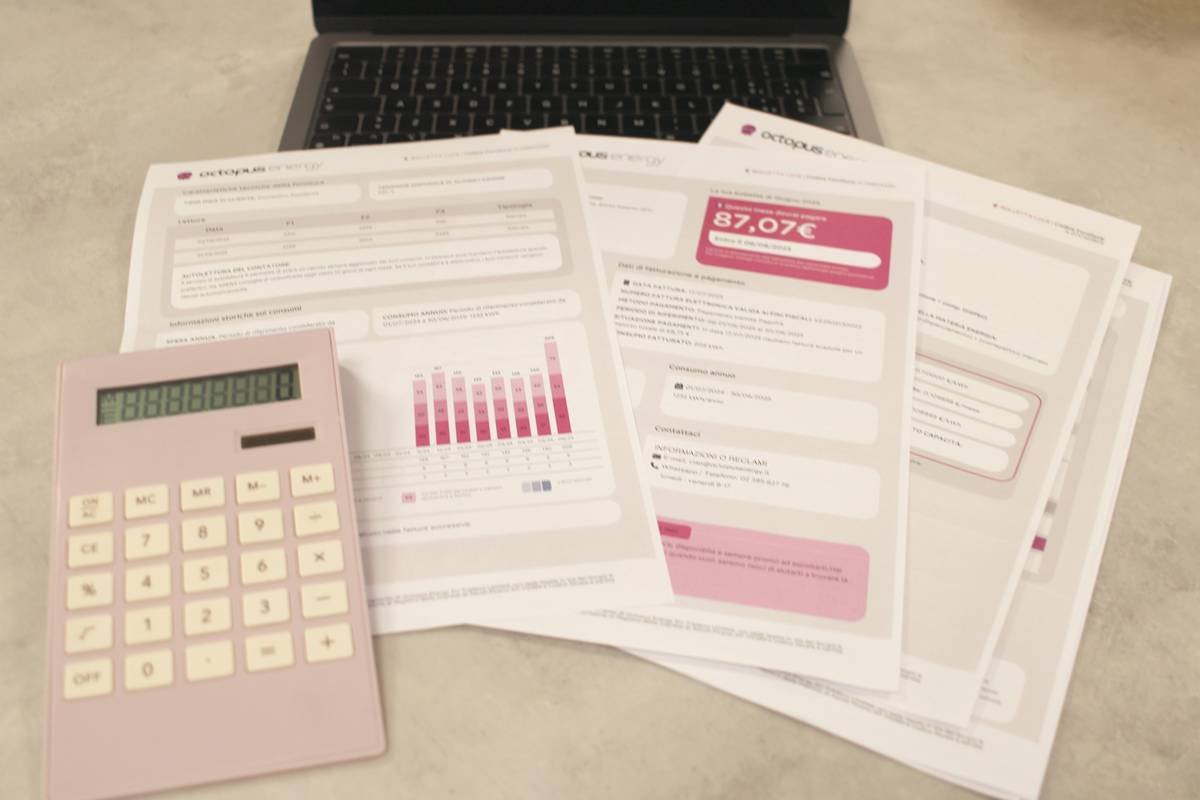

I once tried budgeting using nothing but pen, paper, and sheer willpower. Spoiler alert: It failed faster than my attempt at sourdough during quarantine. The problem wasn’t discipline—it was clutter. Tracking each coffee run, bill, and impulse buy became overwhelming, leaving me frustrated and back at square one. Sound familiar?

That’s where a simple budget planner, especially when paired with coaching apps, saves the day. These tools strip away complexity, letting you focus on what matters—spending smarter, saving steadily, and achieving peace of mind. Plus, who doesn’t love the dopamine hit of ticking off financial milestones?

“Optimist You”: ‘Let’s finally get our finances together!’

“Grumpy You”: ‘Yeah, yeah—only after three cups of coffee.’

Step-by-Step Guide to Using Coaching Apps for Budgeting

Ready to turn from Financial Mess into Money Whisperer? Here’s how to use coaching apps alongside your simple budget planner:

Step 1: Pick Your Perfect App

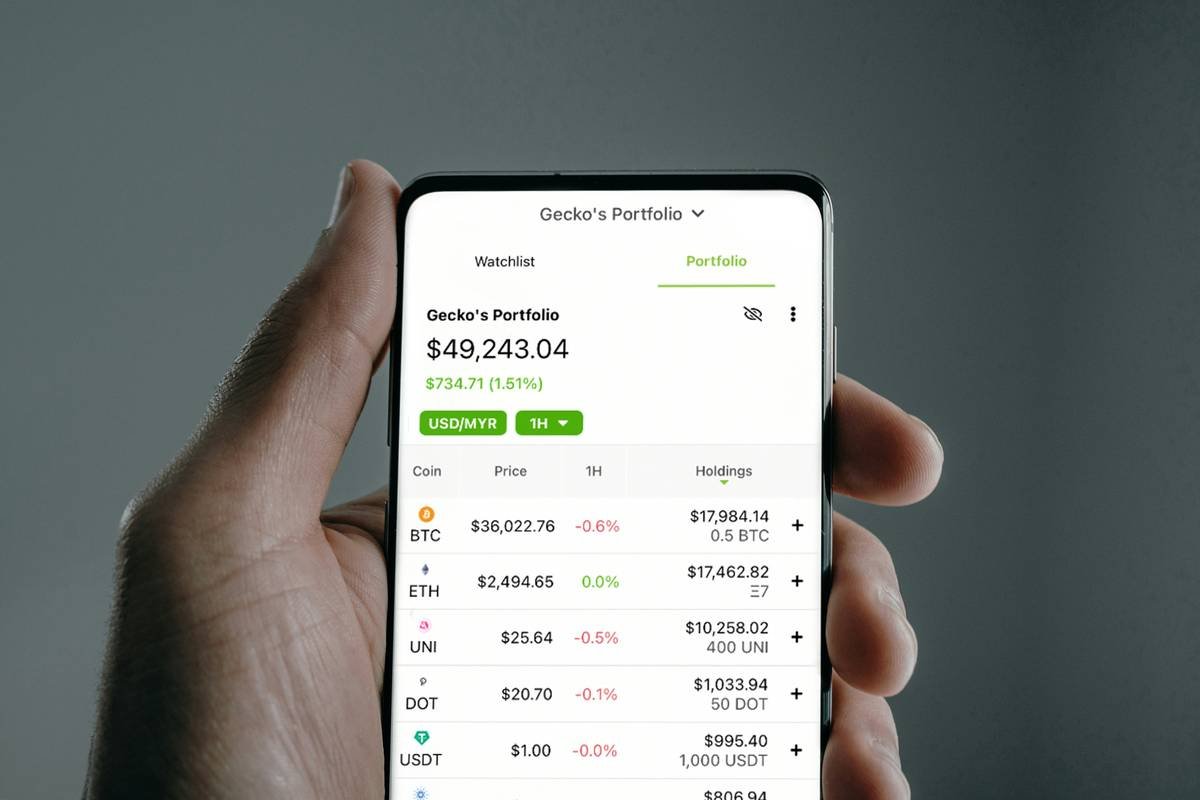

Not all apps are created equal. Some, like Mint, YNAB (You Need A Budget), and PocketGuard, are specifically built for users craving simplicity. Start by downloading one that resonates with your style—minimalistic or feature-packed—and dive in.

Step 2: Sync Accounts and Automate Tracking

No manual entry required here! Sync your bank accounts, credit cards, and subscriptions within the app. Automation ensures every expense flows seamlessly into your simple budget planner, giving you real-time visibility without lifting a finger.

Step 3: Set Clear Goals

What’s your why? Whether it’s paying off debt, building an emergency fund, or planning a dream vacation, your goals fuel motivation. Use the app’s goal-setting features to break big dreams into bite-sized steps.

Step 4: Review Weekly Check-Ins

Set aside 15 minutes weekly to review your progress. Look for patterns—is Starbucks draining your wallet? Adjust accordingly, and celebrate small wins along the way.

Pro Tips for Maximizing Your Simple Budget Planner

- Name Your Categories Wisely: Instead of “Food,” try naming it “Taco Tuesdays”—it’s fun and keeps you accountable.

- Use Push Notifications: Let reminders nudge you toward good habits, like logging expenses or staying under budget.

- Leverage Educational Content: Many coaching apps include courses or articles. Absorb them—it’s like free financial therapy.

- (Warning): Avoid shiny new apps daily. Stick to one platform until you master it. Switching too often = losing momentum.

Real-Life Wins: How Coaching Apps Transformed Finances

Meet Sarah, a freelance designer drowning in irregular income streams. She swore by ziploc bag cash envelopes until she discovered PocketGuard paired with a simple budget planner. Within six months, she paid off $4,000 in debt and started her first investment account. Or take Mike, whose subscription bloat nearly bankrupted him—he used YNAB to slash unnecessary fees by 75%. These aren’t rare exceptions—they’re proof that coaching apps work wonders when wielded correctly.

Frequently Asked Questions About Simple Budget Planners

Q: Are coaching apps safe?

A: Yes, reputable apps use bank-level encryption to protect your data. Always check reviews and privacy policies before diving in.

Q: Can I use multiple apps?

A: While possible, it might lead to analysis paralysis. Stick to one primary planner-app combo for now.

Q: How much do they cost?

A: Most start free, with premium versions ranging from $5-$15/month. The ROI? Priceless.

Conclusion

Managing money doesn’t have to suck. With a rock-solid simple budget planner powered by coaching apps, you can kiss financial overwhelm goodbye. Remember: Start small, stay consistent, and let technology handle the heavy lifting. And hey—here’s a bonus haiku:

Coins clink softly bright, Spreadsheets whisper sweet nothings— Budgets bloom like dawn.

Now go forth and slay those bills!