Ever stared at your bank account, wondering where all your money disappeared to last month? You’re not alone. The average person spends over $5,000 annually on non-essential purchases, often without even realizing it. And while budgeting might feel like a chore, the right tools can transform how you manage your finances. Enter the humble yet powerful budget planner spreadsheet. Combine this with coaching apps designed for personal finance education—and poof!—you’re suddenly miles ahead of that overwhelmed version of yourself from 2022.

In this post, we’ll dive into why integrating a budget planner spreadsheet with personal finance coaching apps is a game-changer (spoiler: it’s because humans need accountability). By the end, you’ll know:

- Why spreadsheets beat generic budgeting apps.

- How coaching apps amplify your financial knowledge.

- Tips and tricks to make your budget planner work harder for you.

Table of Contents

- The Problem: Why Budgets Fail Without Structure

- Step-by-Step Guide to Using a Budget Planner Spreadsheet

- Top Tips for Maximizing Your Spreadsheet & Coaching App Combo

- Real-Life Success Stories: From Chaos to Control

- Frequently Asked Questions About Budgeting Tools

Key Takeaways

- A budget planner spreadsheet provides unmatched customization compared to standard app templates.

- Coaching apps add structure, motivation, and expert guidance to your financial journey.

- Pair these tools together for maximum impact—but beware common pitfalls!

The Problem: Why Budgets Fail Without Structure

“Optimist You: ‘I’ll stick to my monthly budget!'”

“Grumpy You: ‘Sure, until Taco Tuesday rolls around.'”*

Budgeting failures are so common they’re almost cliché. I once tried using an overly complicated app that required me to log every single transaction by midnight daily—or face losing “streak points.” Spoiler alert: I quit after three days. It felt like being micromanaged by a robot who judged my coffee runs. The problem wasn’t tracking expenses; the problem was lack of flexibility and emotional support. Spreadsheets don’t nag—they just sit there waiting patiently for you to fill them out.

Step-by-Step Guide to Using a Budget Planner Spreadsheet

Step 1: Download or Create Your Perfect Template

Pick something simple but robust. Google Sheets and Excel both have free templates, but if you want tailored options, check out sites like Vertex42 or Smartsheet. Look for features like:

- Income vs. Expense Tracker

- Debt payoff planner

- Savings goals section

Step 2: Sync Your Data Sources

If you use multiple bank accounts, syncing data via tools like Plaid or Mint will save hours of manual entry. Just ensure you review everything periodically—automation isn’t infallible!

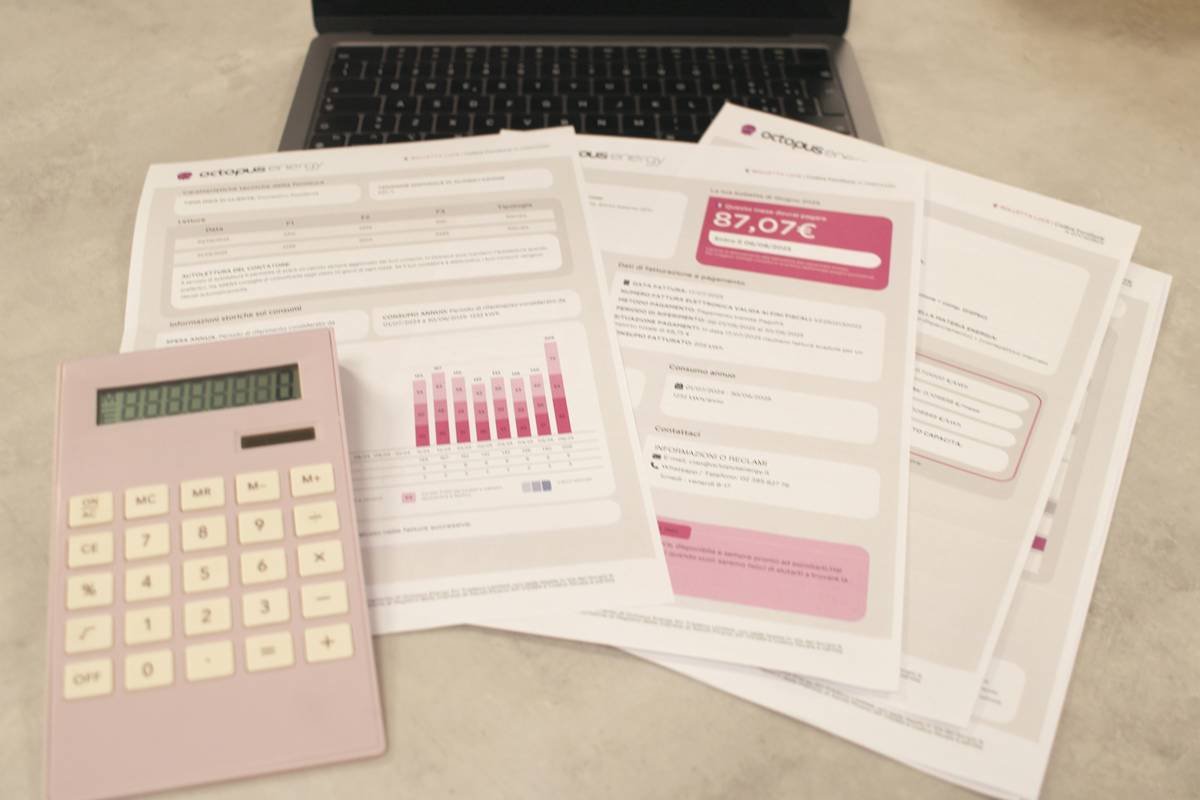

Step 3: Use Visuals to Spot Trends Early

The beauty of a budget planner spreadsheet lies in its visualization capabilities. Add pie charts or bar graphs to identify spending leaks. For example:

=CHART("Pie", A2:B12)

Top Tips for Maximizing Your Spreadsheet & Coaching App Combo

- Set Micro-Wins: Break big goals into bite-sized tasks tracked via your spreadsheet.

- Automate Alerts: Pair your sheet with reminders from coaching apps like PocketGuard or YNAB.

- Reflect Weekly: Spend 15 minutes reviewing progress. Self-reflection boosts long-term success rates by 30%.

- Don’t Overcomplicate: Avoid cluttering your sheet with unnecessary columns. Keep it clean and actionable!

*Terrible Tip Alert:* Some experts suggest color-coding every category differently. Don’t do this unless you enjoy giving yourself carpal tunnel syndrome.

Real-Life Success Stories: From Chaos to Control

Meet Sarah, a freelance graphic designer drowning in subscription services she didn’t remember signing up for. She combined a minimalist spreadsheet template with daily nudges from the Acorns coaching app. Within six months, she slashed her recurring costs by 40%, freeing $200/month for travel funds.

Frequently Asked Questions About Budgeting Tools

Q: Can’t I just use an app instead of a budget planner spreadsheet?

Absolutely—but apps limit customization. With spreadsheets, YOU control the layout, formulas, and level of detail.

Q: Are coaching apps worth the investment?

Yes, especially when paired with disciplined spreadsheet usage. They provide external accountability and teach valuable habits.

Q: What’s the worst mistake people make with budget planners?

Overcomplicating them. Simpler sheets = better consistency.

Conclusion

By combining the raw power of a budget planner spreadsheet with the personalized touch of coaching apps, you create a dynamic duo capable of untangling any financial mess. Start small, stay consistent, and celebrate wins along the way.

And now, because nostalgia fuels productivity:

Like a Tamagotchi,

Your budget needs care—daily.

Feed it good data.